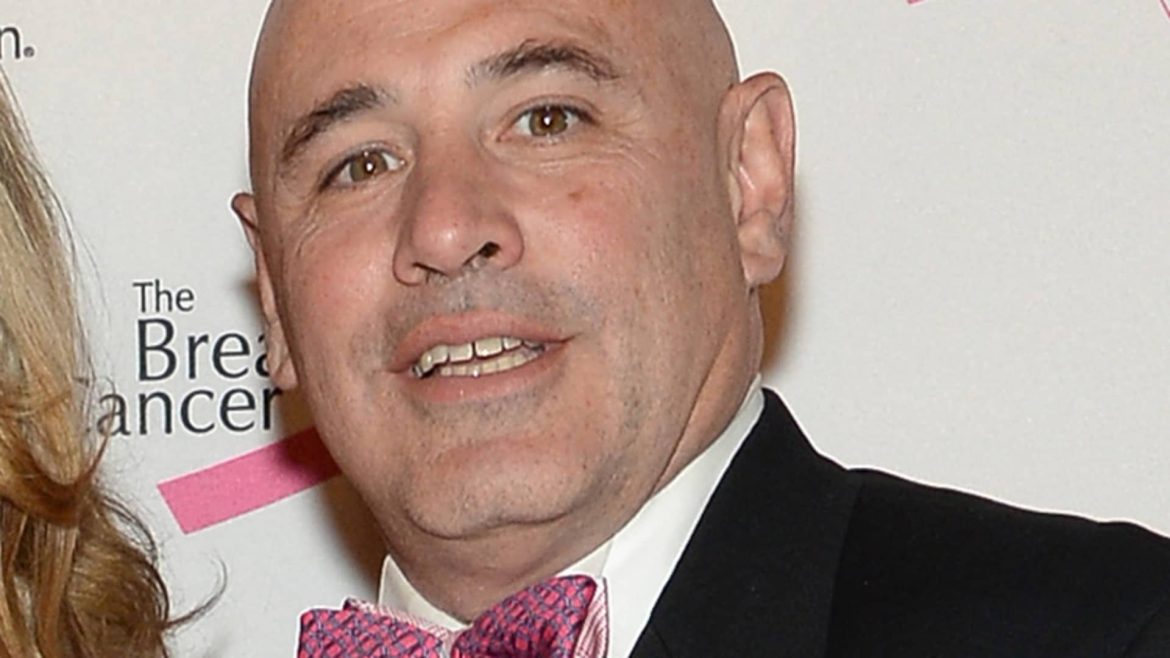

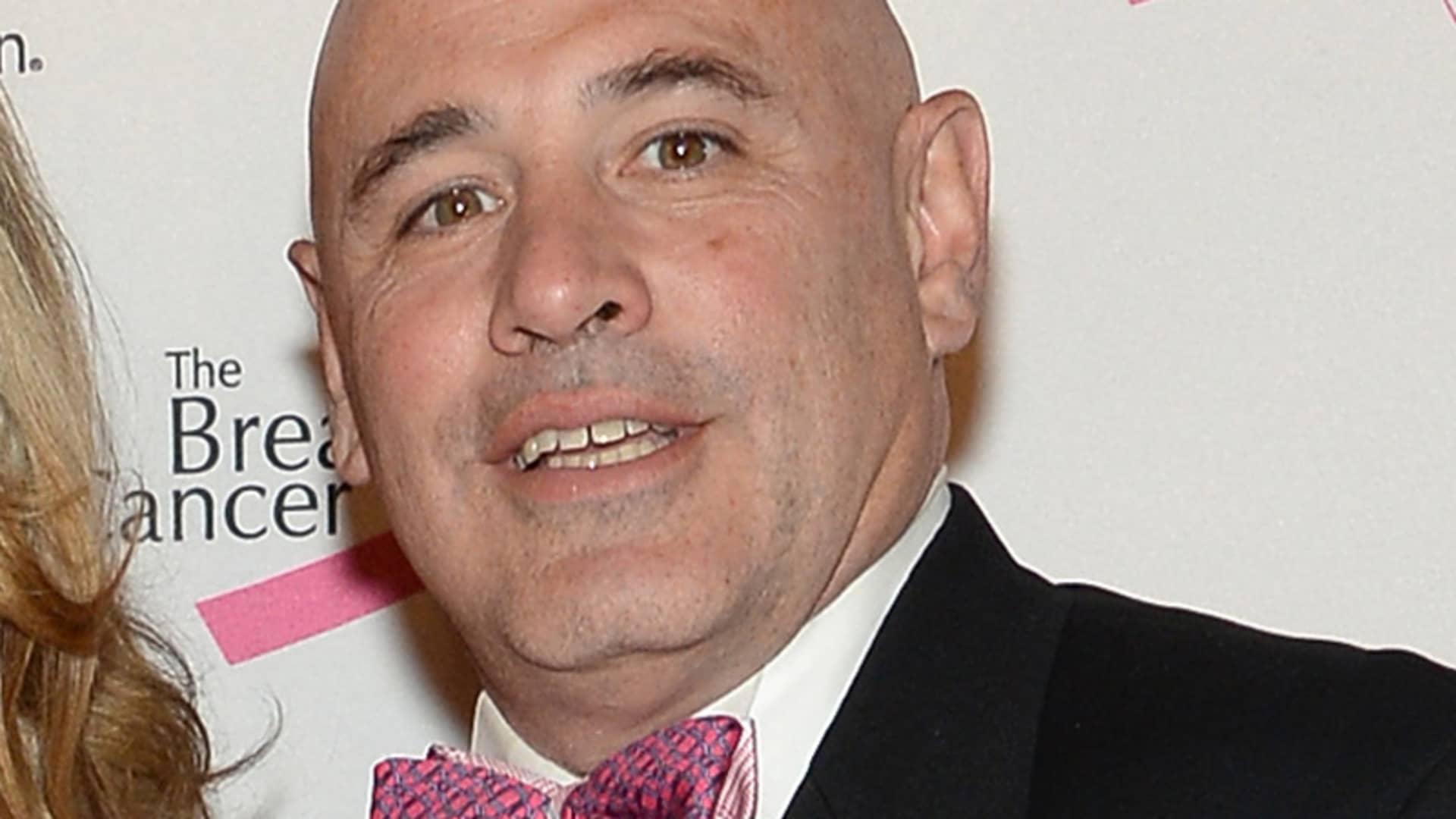

Robert Citrone, a prominent figure in the hedge fund industry, has built a reputation for his astute market predictions and strategic investment decisions. His recent bearish outlook on the market, coupled with his impressive track record, provides a compelling case study in navigating the complexities of global finance. Citrone’s journey, from founding Discovery Capital Management to forecasting market corrections, highlights the importance of adaptability, risk management, and informed decision-making in an ever-evolving economic landscape.

Citrone’s career is marked by significant achievements, including the establishment of Discovery Capital Management, a $1.2 billion emerging market hedge fund. His Discovery Global Opportunity Fund has delivered substantial gains, cementing his status as a top-tier fund manager. Notably, Citrone’s ability to generate impressive returns, such as a $730 million gain in a single year, underscores his expertise in identifying and capitalizing on market opportunities. His success is rooted in agile, research-driven investment strategies that enable him to navigate the intricacies of global finance effectively.

In recent times, Citrone has adopted a more cautious, even bearish, stance on the market. This shift is driven by a keen awareness of underlying economic vulnerabilities and potential risks. His forecast of a notable market correction suggests a belief that current valuations may be unsustainable, warranting a strategic repositioning. Citrone’s decision to cut his long equity portfolio and adopt a net short position in U.S. equities reflects a proactive approach to mitigating potential losses and capitalizing on anticipated market declines. This move aligns with broader market trends, where investors are increasingly hedging against potential downturns.

Several factors contribute to Citrone’s bearish outlook. Macroeconomic indicators, such as inflation, interest rates, and geopolitical tensions, play a crucial role in shaping market sentiment and performance. Concerns about overvalued assets, speculative bubbles, and the potential for unexpected shocks to the global economy may also inform Citrone’s analysis. Additionally, shifts in investor behavior, regulatory changes, and technological disruptions can contribute to market volatility and uncertainty. The experiences of other prominent investors, such as Prem Watsa’s focus on value investing, highlight the ongoing debate about investment strategies in a rapidly changing environment.

In light of Citrone’s forecast and the inherent uncertainties of the market, investors must consider strategies to protect their portfolios and capitalize on emerging opportunities. Diversification remains a fundamental principle, spreading investments across different asset classes, sectors, and geographic regions to reduce risk. Active risk management, involving continuous monitoring and adjustments to portfolio allocations, is also crucial. Investors may consider hedging strategies, such as short selling or buying put options, to protect against potential market declines. Furthermore, a focus on fundamental analysis, assessing the intrinsic value of assets based on underlying financial metrics, can help identify undervalued opportunities and avoid speculative bubbles.

Despite his overall bearish outlook, Citrone continues to identify opportunities in specific sectors and individual stocks. His focus on small-cap stocks with significant upside potential suggests a belief that certain companies may be undervalued by the market. Small-cap stocks, typically those with a market capitalization of less than $2 billion, can offer higher growth potential than larger, more established companies. However, they also come with greater risk due to their smaller size, limited trading volume, and potential for volatility. Careful due diligence and a thorough understanding of the companies’ fundamentals are essential when investing in small-cap stocks.

Citrone’s success and strategic shifts reflect the evolving nature of the investment landscape. The rise of agile, research-driven hedge funds underscores the importance of adaptability and a willingness to challenge conventional wisdom. In an era of rapid technological change, globalization, and increased market volatility, investors must be prepared to adjust their strategies and embrace new approaches. This includes leveraging data analytics, artificial intelligence, and other advanced tools to gain a competitive edge. Furthermore, a focus on sustainable and responsible investing, considering environmental, social, and governance (ESG) factors, is gaining increasing importance among investors.

Citrone’s moves mirror a broader trend observed among top hedge funds, a shift from technology-led stock rallies towards value stocks and blank-check acquisition companies. This transition suggests a growing skepticism towards the high valuations of some technology companies and a renewed interest in more traditional, undervalued sectors. Value investing, which focuses on identifying companies trading below their intrinsic value, has historically been a successful strategy for generating long-term returns. Blank-check companies, also known as special purpose acquisition companies (SPACs), offer an alternative route for private companies to go public, but they also carry inherent risks due to their speculative nature.

Robert Citrone’s bold calls and strategic repositioning serve as a reminder of the ever-present uncertainties in the financial markets. His forecast of a market correction underscores the importance of vigilance, risk management, and a willingness to adapt to changing conditions. While the future remains unpredictable, investors can navigate the shifting sands of the market by staying informed, diversifying their portfolios, and embracing a long-term perspective. Citrone’s journey, marked by both triumphs and strategic adjustments, offers valuable lessons for anyone seeking to succeed in the complex and dynamic world of finance. His ability to anticipate market shifts and adapt his strategies accordingly provides a blueprint for navigating the challenges and opportunities that lie ahead.