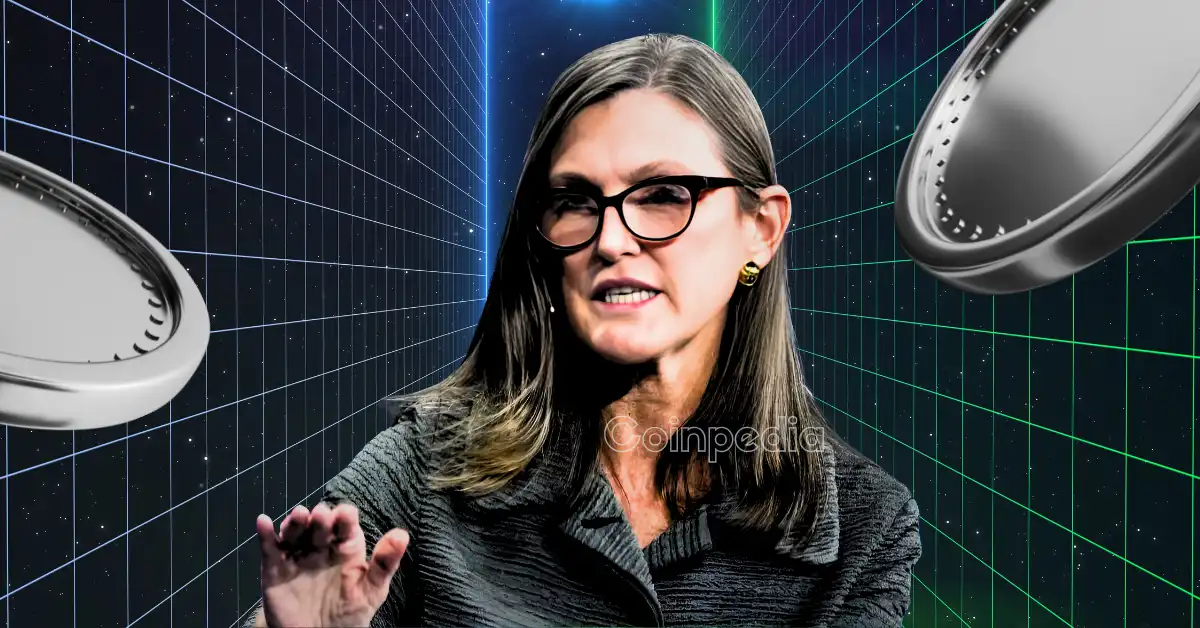

Exploring ARKK: Cathie Wood’s Flagship Innovation ETF

Cathie Wood’s ARK Innovation ETF (ticker: ARKK) stands as a beacon for investors seeking exposure to disruptive innovation. This actively managed ETF targets companies pushing the technological frontier, aiming for long-term capital growth by investing primarily in equity securities related to transformative themes. Understanding ARKK’s strategy, holdings, performance, and investment philosophy provides insight into its appeal and challenges in the rapidly evolving tech landscape.

Investment Objective and Strategy

ARKK’s core objective is to generate long-term growth by investing at least 65% of its assets under normal circumstances in domestic and foreign equities that align with the theme of disruptive innovation. This theme encompasses sectors such as artificial intelligence (AI), robotics, genomics, blockchain, and other cutting-edge technologies. Unlike passive ETFs that track indexes, ARKK’s active management approach allows the fund’s team to dynamically allocate assets to high-conviction ideas and emerging trends.

Cathie Wood’s investment style is characterized by a readiness to embrace volatility and a strong conviction in transformational technologies that may redefine entire industries. This is reflected in ARKK’s frequent trading and allocation shifts, which aim to capitalize on rapid sector evolutions and company growth trajectories.

Composition and Top Holdings

The fund’s holdings have expanded from a concentrated few to around 60 different names, reflecting a diversification within innovation sectors. Tesla (TSLA) consistently remains ARKK’s largest position, with valuations growing from approximately $200 million in 2019 to $750 million in recent times. Tesla’s pioneering role in electric vehicles and energy innovation closely aligns with ARKK’s disruptive ethos.

Other significant holdings include:

– Coinbase Global (COIN): A key player in cryptocurrency exchanges, tapping into blockchain and digital asset markets.

– Roku (ROKU): Streaming technology firm, capitalizing on shifts in media consumption.

– Shopify (SHOP): E-commerce platform innovating retail technology.

– Teladoc (TDOC): Telemedicine service provider, representing healthcare innovation.

– Palantir Technologies (PLTR): AI-driven data analytics company, signaling ARKK’s focus on enterprise tech.

– Roblox (RBLX): A social gaming and metaverse platform, representing ARKK’s interest in immersive digital experiences.

– GitLab (GTLB): Software development and AI tools company, highlighting ARKK’s engagement with data infrastructure.

This diversified basket reflects a broad exploration of disruptive technologies, balancing high-risk, high-reward opportunities.

Embracing Emerging Trends in 2025

ARKK’s 2025 strategy underscores continued emphasis on innovation, with specific focus areas such as:

– Artificial Intelligence: Investing in companies harnessing AI for automation, data analysis, and decision-making enhancement.

– Metaverse and Digital Experiences: Supporting platforms like Roblox, which build immersive virtual worlds.

– Cryptocurrency and Blockchain: Maintaining stakes in firms like Coinbase that facilitate cryptocurrency markets.

– Autonomous Vehicles and Robotics: Tesla remains a cornerstone, while other robotics and autonomous tech play important roles.

Cathie Wood has also been bullish on companies like AMD, reinforcing ARKK’s alignment with semiconductor innovation vital for AI and computing power.

Performance and Market Sentiment

Since its launch in 2014, ARKK has delivered roughly 12% annualized returns, though the journey has been volatile. While certain Ark funds like ARKQ (Automotive Tech & Robotics ETF) and ARKW (Next Generation Internet ETF) have returned over 10% annually for five-year periods, ARKK’s broader innovation exposure introduces steadier swings.

The fund experienced sharp gains during periods of pandemic euphoria, fueled by heightened demand for tech and digital services. However, as sentiment normalized, ARKK saw corrections, reflecting the inherent risk of investing in early-stage innovation companies. Despite criticisms about volatility and recent bouts of underperformance, the ETF has marked a resurgence in 2025, reaching its highest trading levels since 2022.

Critical Views and Challenges

ARKK’s bold bet on emerging technologies comes with considerable risks:

– Volatility: Stocks in disruptive sectors can swing dramatically due to regulatory changes, technological breakthroughs, or market sentiment shifts.

– Valuation Concerns: Many holdings trade at high multiples due to future growth expectations, risking sharp corrections if targets aren’t met.

– Concentration Risks: While holdings have diversified, Tesla and a handful of large caps still constitute significant portfolio weight.

– Market Cycles: Changes in interest rates, economic conditions, or investor appetite for growth stocks can impact performance.

These aspects have led some analysts to question Ark Invest’s consistency, with some labeling certain funds among the worst performers in their categories during difficult periods.

Cathie Wood’s Investment Philosophy in Action

Wood’s approach champions:

– Open Research: Ark Invest publicly shares its research to engage investors and maintain transparency about future trends.

– High Conviction: Concentrated investments in chosen disruptive themes and companies.

– Fast Trading: Active portfolio adjustments enable quick response to technological shifts.

– Long-Term Vision: Belief that innovation-driven companies will eventually redefine markets and achieve superior returns over many years.

This philosophy not only shapes ARKK’s holdings but also defines its brand as a disruptive innovation investor willing to embrace short-term pain for long-term potential.

Conclusion: The Innovative Frontier Beckons

ARKK offers investors a unique avenue to ride the wave of transformative technological change. Cathie Wood’s audacious vision endows the fund with a daring personality—one that prizes future potential over immediate stability. While volatility and risk are inherent, ARKK’s curated portfolio of cutting-edge companies holds considerable promise for those comfortable with innovation’s uncertainties. Whether Tesla’s continued leadership, AI’s explosion, or the rise of new digital economies, ARKK embodies a bold exploration of the frontiers shaping tomorrow’s world.