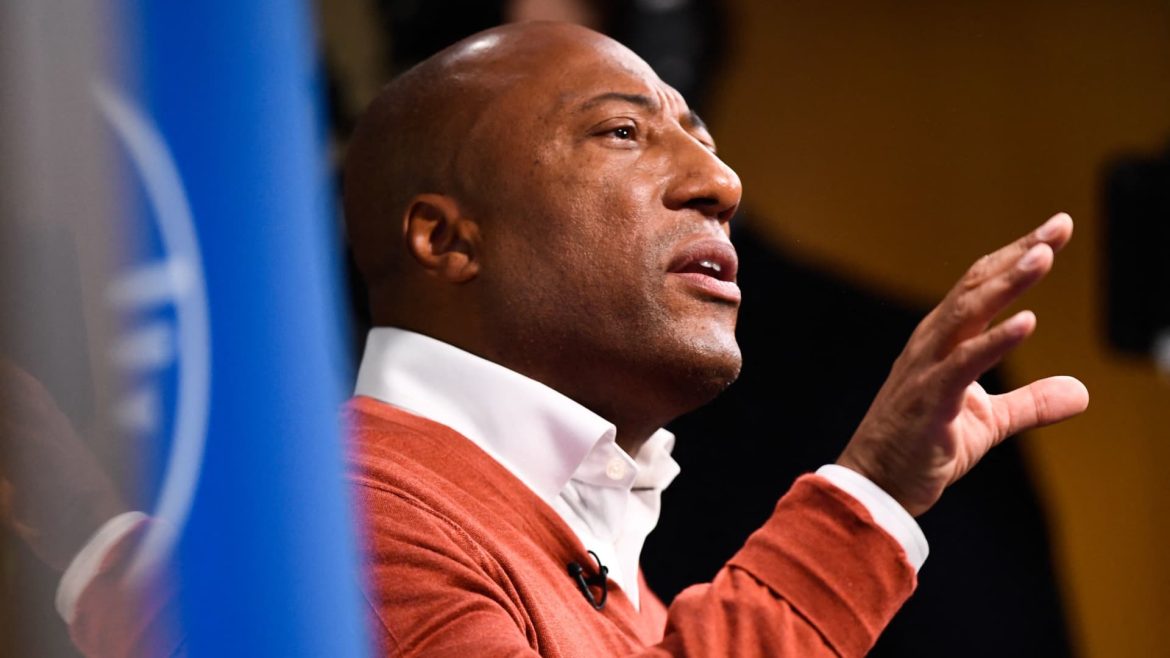

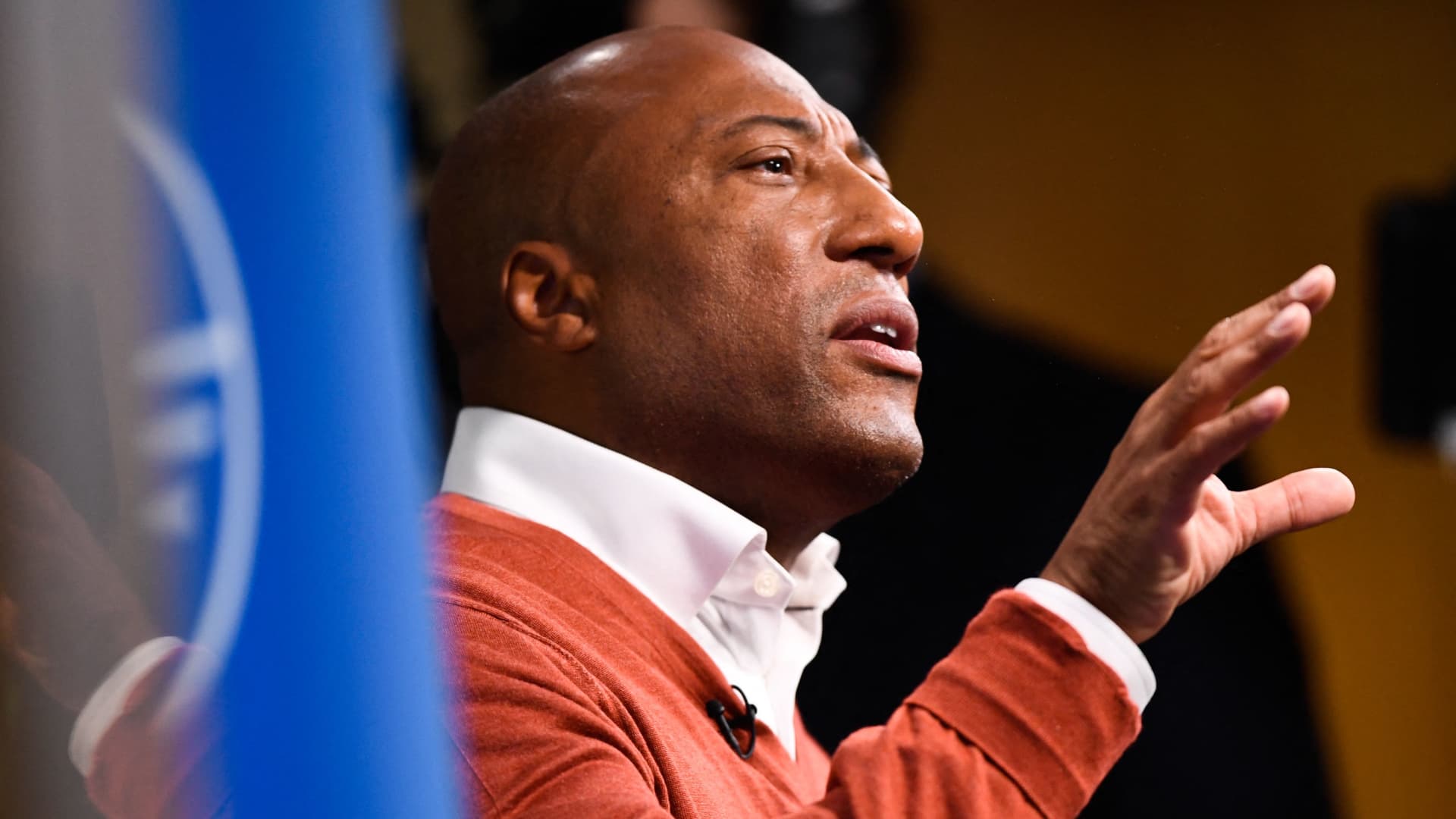

Byron Allen’s Strategic Shift: Selling Local TV Stations Amid Industry Changes

Byron Allen, a prominent media mogul known for his extensive acquisitions in the television broadcasting landscape, is undertaking a significant repositioning of his business by putting his local TV stations up for sale. This move holds considerable implications for the media industry, reflecting both Allen’s evolving strategic outlook and broader trends shaping broadcast television.

Background: Building a Broadcasting Empire

Over the past decade, Byron Allen’s Allen Media Group (AMG) has aggressively expanded into local TV broadcasting. Beginning with the acquisition of several small-market stations, Allen rapidly grew his portfolio, reaching ownership of 28 ABC, NBC, CBS, and Fox affiliate stations across 21 U.S. markets. This expansion was marked by investments totaling over $1 billion, demonstrating Allen’s commitment to becoming one of the largest privately held owners of local broadcast stations in America.

Key milestones in Allen’s broadcasting ventures include a $165 million deal in 2019 for four small-market stations and a $380 million acquisition of seven Gray Television stations. These strategic purchases bolstered AMG’s footprint in network-affiliated local television. The company’s holdings featured a diversified mix of markets and network partnerships, enabling cross-platform opportunities spanning syndicated programming, digital media, and local advertising.

The Decision to Sell: Market and Financial Considerations

Despite this impressive accumulation, Allen Media Group recently retained investment bank Moelis & Company to market and sell its broadcast TV stations. The decision to divest is shaped by multiple converging factors:

– Debt Management: Reports indicate the sale aims to reduce AMG’s substantial debt incurred from station acquisitions. Offloading local properties would provide liquidity to strengthen AMG’s balance sheet.

– Industry Headwinds: The broadcast TV sector faces disruption from digital streaming, changing viewer habits, and regulatory uncertainty, including the transition from ATSC 1.0 to newer broadcast standards. Such dynamics introduce risk and operational complexity to traditional station ownership.

– Strategic Realignment: Allen’s ambitions are expanding beyond local TV into larger national deals and digital content ventures. For instance, Allen offered an estimated $10 billion bid for major Disney assets like ABC, FX, and National Geographic channels, signaling a preference to pursue scale and premium content ownership over localized broadcast holdings.

– Consolidation Trends: The broader broadcast industry is experiencing consolidation, with hedge funds, large media companies, and private equity firms acquiring local station groups. Allen’s exit aligns with this trend, positioning AMG to redeploy capital where it sees greater growth potential.

Impact on the Broadcast Landscape

Allen Media Group’s sale of 28 local stations across 21 markets is significant in scale and market presence. These stations hold affiliations with all the major network broadcasters, affecting local news ecosystems, advertising markets, and syndication pipelines.

Potential buyers could include national conglomerates, private equity groups, or other regional broadcasters looking to consolidate footprint and audience reach. The successful divestiture depends on market appetite for traditional broadcast assets amid ongoing shifts toward streaming and digital platforms.

Furthermore, Allen’s exit invites reflection on how media entrepreneurs balance local media ownership with ambitions in content creation, distribution, and technology. His trajectory—from syndication pioneer to station owner to major network suitor—illustrates evolving strategies in a turbulent media environment.

The Road Ahead: Byron Allen’s Media Empire Evolution

Byron Allen’s move to sell local TV stations does not denote retreat but rather strategic evolution. By shedding these holdings, AMG is likely positioning for larger-scale media acquisitions, deeper investments in digital content networks, and innovative programming initiatives. This recalibration could enable Allen to focus on national and international media opportunities, leveraging his expertise in content production and distribution.

At the same time, the sale marks an inflection point in local broadcasting—raising questions about the future of independent station ownership and the role of diversified media companies in maintaining local news and community engagement.

—

Conclusion: A Calculated Pivot in an Uncertain Media Landscape

Byron Allen’s decision to place his local TV stations on the market illustrates a thoughtful pivot responsive to financial realities, industry transformation, and emerging growth avenues. His journey embodies the complex balancing act media entrepreneurs face: managing legacy assets while striving for innovation and scale. As Allen Media Group prepares to divest its broadcast properties, the move underscores the media sector’s rapid evolution and the ongoing recalibration of business models in the digital age.