Navigating Nvidia’s Stock Trajectory: Jim Cramer’s Insights and Market Dynamics

Nvidia’s stock has captured significant attention lately, buoyed by its pivotal role in artificial intelligence (AI) chip technology and broader tech innovation. Jim Cramer, a prominent and often provocative market commentator, offers a nuanced perspective on what lies ahead for Nvidia (NASDAQ: NVDA). His commentary blends optimism about future growth catalysts with cautionary advice about managing volatility and market noise. This analysis synthesizes Cramer’s key insights with prevailing market trends, underscoring factors that could drive Nvidia’s stock further upward or test investor resolve.

—

The Road to a 40% Upside: Key Drivers Identified by Jim Cramer

Sovereign AI and China as Growth Catalysts

Cramer highlights “sovereign AI” initiatives and China as two critical factors that could propel Nvidia’s stock price by over 40% from current levels, potentially reaching $200 per share. Sovereign AI refers to nations developing their own AI capabilities, which heavily depend on cutting-edge processors like Nvidia’s GPUs for training and inference. As countries invest in independent AI infrastructure, Nvidia stands to benefit from increased demand for its hardware.

China’s market, despite geopolitical tensions and regulatory hurdles, remains a focal point. If Nvidia can navigate trade restrictions and tap into China’s expansive AI and data center growth, it could unlock a significant revenue stream that would validate the bullish price target.

—

Market Sentiment and Volatility: “No Man’s Land” and Meme Stock Status

Despite Nvidia’s fundamental strength, Cramer describes the stock as being in “no man’s land,” indicating a zone of uncertainty where investor sentiment is split. Previously labeled a “meme stock” by Cramer, Nvidia’s rapid rise and sharp corrections reveal a stock driven by both hype and real technological leadership. This duality means investors can face strong volatility.

Following Nvidia’s remarkable 195% surge since Cramer’s bearish call in 2022, he now advocates a more measured approach. Recognizing the stock’s indispensability in AI and gaming, he suggests cautious trimming of positions to lock in profits while maintaining exposure to long-term growth.

—

Managing Gains and Risks: Two Timeless Investment Rules

Cramer conveys key principles for investors “sitting on huge profits” in Nvidia, which echo wise trading discipline. First, locking in gains gradually rather than chasing after every spike helps mitigate risks of sharp pullbacks—a phenomenon Nvidia has witnessed post-earnings due to high expectations baked into prices.

Second, understanding that Nvidia’s growth is tied to macroeconomic, geopolitical, and technological forces implies investors can’t treat it like a typical buy-and-hold stock anymore. Instead, active management aligned with news on trade policies, AI demand, or competitor moves (e.g., AMD) is prudent.

—

Earnings and Market Reactions: Catalyst or Hurdle?

Analysts and Cramer alike scrutinize Nvidia’s earnings reports as pivotal moments shaping near-term stock direction. While strong earnings often fuel enthusiasm, Cramer cautions that even blockbuster results may not instantly translate into uninterrupted rallies if broader market concerns dominate.

Nvidia’s Q1 earnings showcased strength in AI-driven revenue growth. Yet, Cramer advises waiting and watching rather than sprinting into positions immediately after earnings surges, emphasizing the importance of absorbing all dimensions of the business environment, including regulatory restrictions and supply chain trends.

—

Broader Market and Geopolitical Context: Tariffs, Trade Wars, and U.S.-China Relations

A recurrent theme in Cramer’s narrative is the impact of geopolitical forces, especially U.S.-China tensions, on Nvidia’s stock trajectory. Tariffs and export restrictions create layers of uncertainty that can curtail Nvidia’s access to critical markets and components.

However, easing tensions or new trade developments could swiftly become stock price catalysts. Cramer cites easing trade relations as potentially unleashing pent-up demand and legitimizing higher stock valuation tiers for Nvidia.

—

Nvidia’s Role in the Next Industrial Revolution

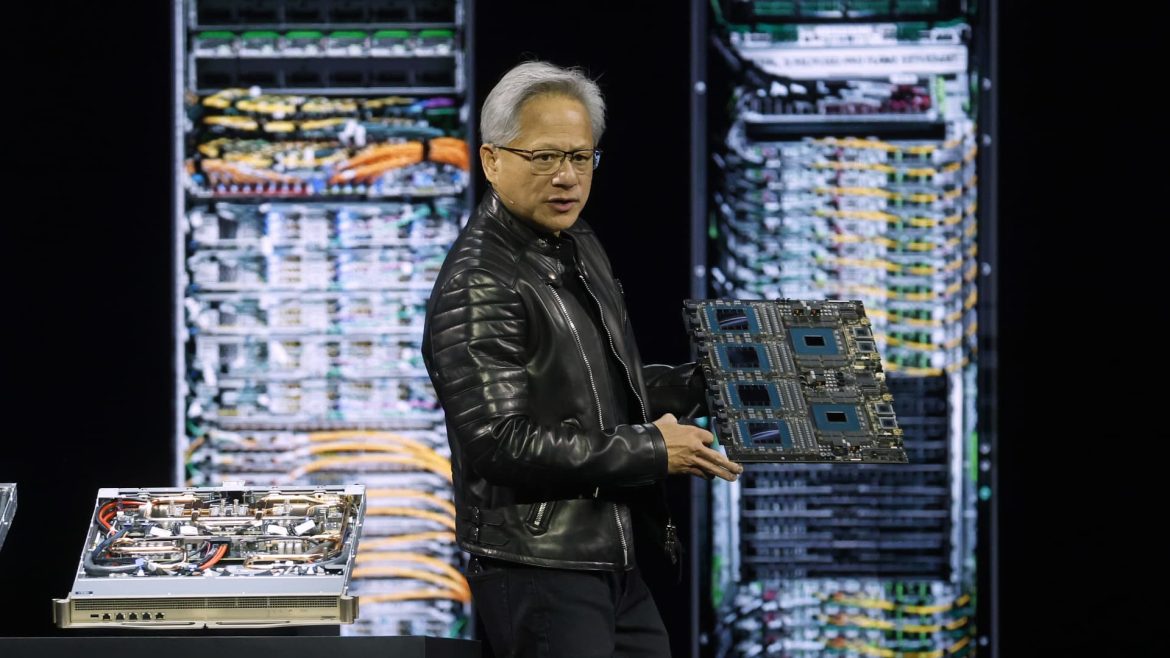

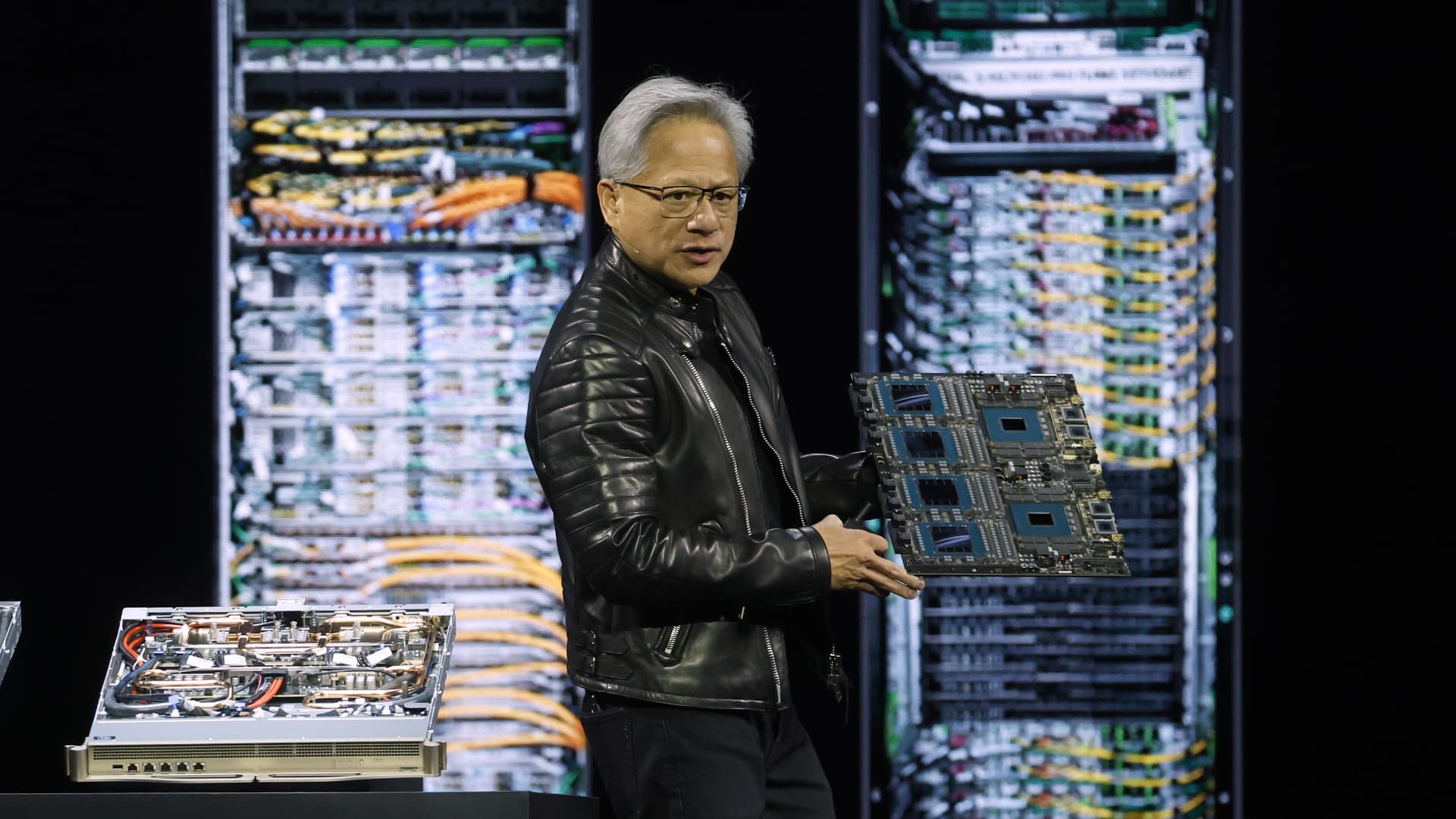

A compelling element in Cramer’s viewpoint is the framing of Nvidia as a technological powerhouse that could “create the next industrial revolution.” The company’s GPUs and software frameworks accelerate AI research, autonomous vehicles, cloud computing, and gaming innovations, which together redefine industries.

This transformative potential provides a solid foundation for sustained investor interest. It also explains why Cramer believes many bear arguments miss the broader narrative of Nvidia’s indispensability in emerging tech ecosystems.

—

Technical and Psychological Market Patterns: Trading Range and Investor Behavior

From a technical standpoint, Nvidia recently traded within a range roughly between $130 and $153 over the past month. Cramer notes that breaking below the lower boundary could signal a short-term downside or consolidation phase, reflecting market participants grappling with overbought conditions or profit-taking.

Investor psychology, including reactions on social platforms like Reddit, further influences Nvidia’s price action. The stock’s meme stock past and retail investor enthusiasm contribute to volatile swings, which savvy investors should monitor.

—

Conclusion: Balancing Optimism with Pragmatism in Nvidia Stock Investment

Jim Cramer’s commentary on Nvidia intricately weaves hope and caution, highlighting potent catalysts such as sovereign AI and China while recognizing that the stock operates in a volatile, geopolitically sensitive environment. For investors, the path forward involves balancing exposure to Nvidia’s transformative technology with prudent management of profits and risks. Earnings reports, trade developments, and market sentiment shifts will remain decisive in shaping Nvidia’s journey toward potentially unlocking another 40% upside. Understanding these dynamics prepares investors to navigate Nvidia’s compelling, yet complex investment landscape with informed confidence.