The Resurgence and Evolution of the AI Stock Market: An In-Depth Analysis

Artificial intelligence (AI) stocks are demonstrating a marked resurgence after a period of volatility and uncertainty, reestablishing themselves as a leading segment within the broader market. This analysis explores recent developments in the AI equity space, delves into the factors driving renewed investor interest, identifies key players poised for growth, and assesses the shifting dynamics beyond established tech giants.

Reigniting Momentum: The AI Industrial Trade Finds Its Footing

After months marked by market fluctuations and investor apprehension regarding a potential slowdown in AI development, the AI industrial trade has regained momentum. This resurgence, notably mentioned in relation to companies like GE Vernova, highlights how AI’s integration into industrial sectors is moving beyond speculative hype into tangible operational advancements.

This shift is significant: industrial firms adopting AI technologies are beginning to demonstrate practical benefits, such as improved efficiency and cost reductions. As such, these companies are no longer just “AI hopefuls” but becoming critical achievers in the AI industrial ecosystem. The recovery in this trade signals broader market confidence that AI applications can deliver real economic value, reinvigorating investor enthusiasm.

A New Bull Run on the Horizon: Top AI Stocks Ready to Lead

Drawing from recent market analyses, three standout AI stocks have been identified as prime candidates for another bullish wave. These include companies with either foundational AI infrastructure roles or those harnessing AI to transform their core businesses effectively. The momentum these stocks carry stems from continued innovation, robust revenue models tied to AI, and their strategic positioning within an ecosystem benefitting directly from AI acceleration.

Nvidia’s spectacular performance exemplifies this trend; analysts anticipate it and similar companies could see gains up to 44%, underscoring the surging demand for AI-related hardware and software solutions. Additionally, Microsoft is highlighted as an AI stock with both scale and strategic clarity, maintaining a price-to-earnings ratio aligned with its long-term averages yet poised for expansive growth due to continued AI investments.

Investment Phases and the Next Frontier: From Chips to AI-Boosted Productivity

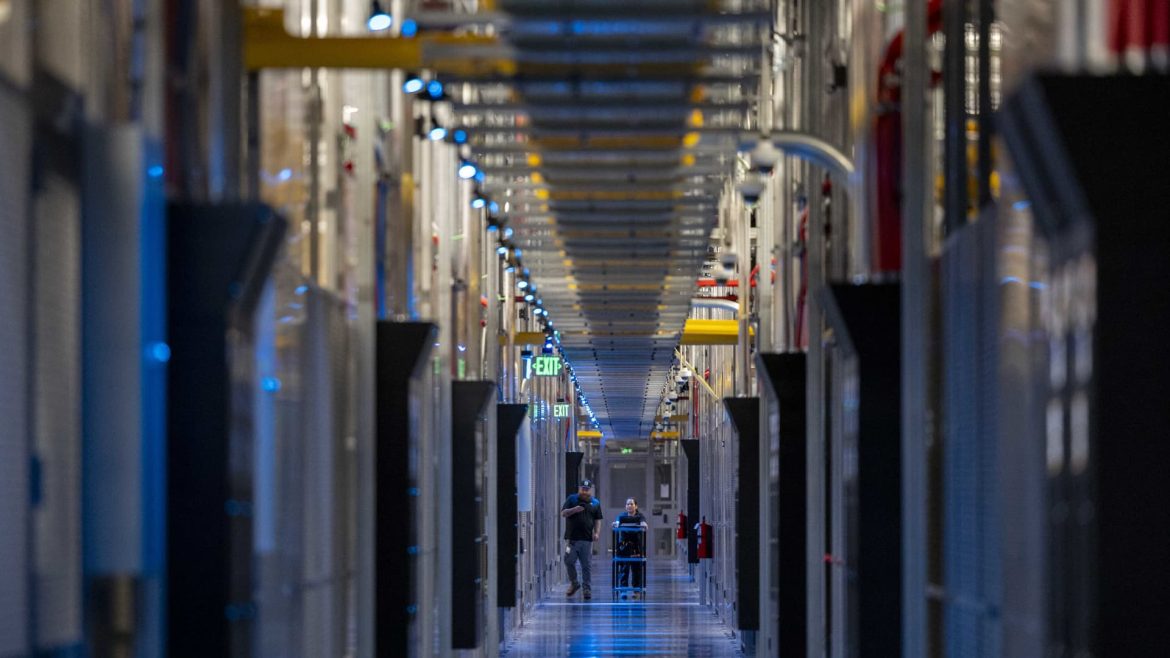

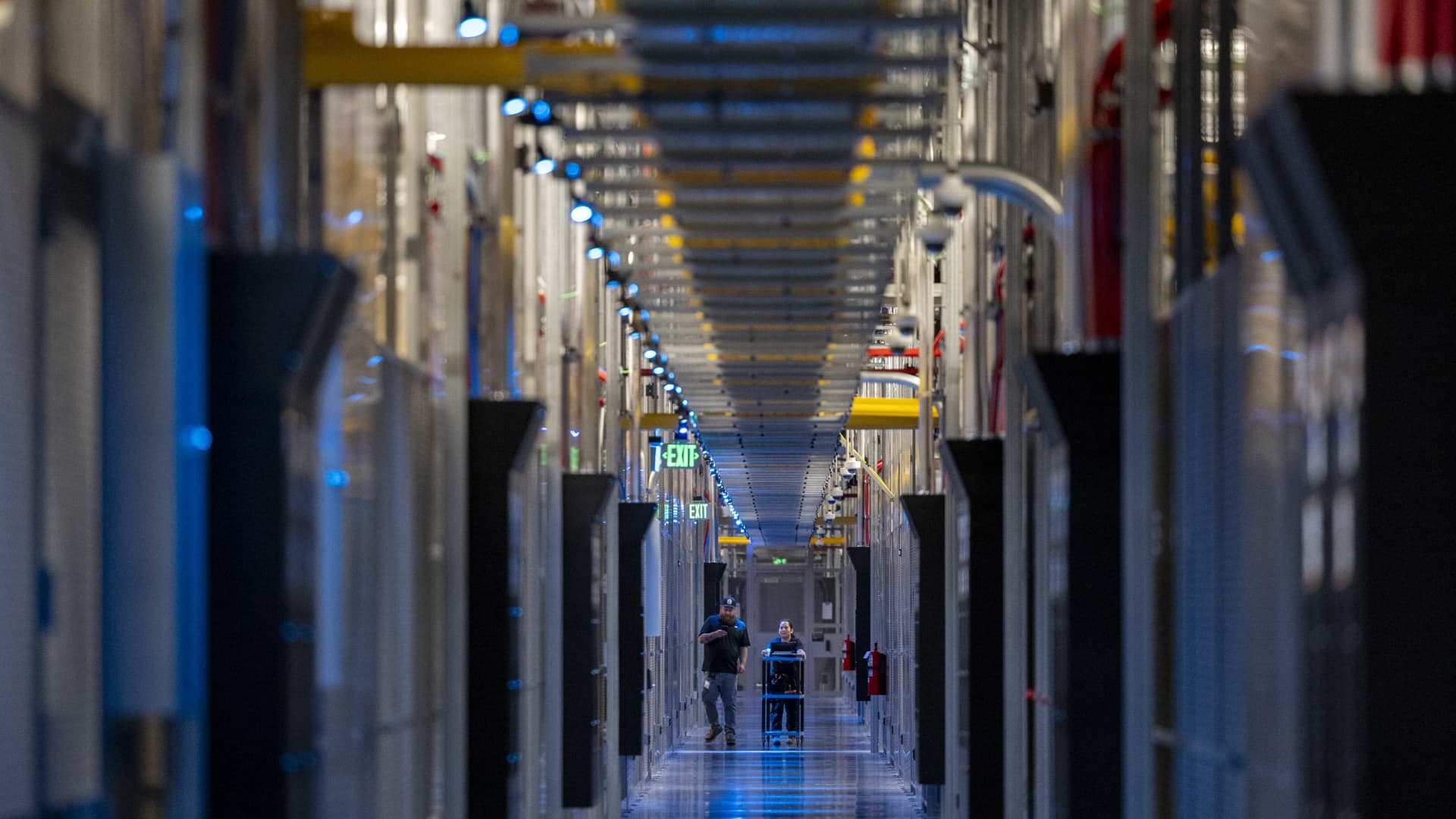

Market strategists propose a framework to understand AI investment dynamics through distinct phases. Initial phases focused on the creation and adoption of AI chips and foundational technologies. The current “Phase 3” is characterized by infrastructure stocks outperforming as investors recognize the essential hardware and platforms fueling AI growth.

Looking ahead, “Phase 4” anticipates a widespread diffusion of AI-driven productivity gains across various industries. This future phase envisions AI not only as a component of tech firms but as an augmentation tool enhancing everything from manufacturing and healthcare to finance and services. The market is beginning to price in these broad-based productivity gains, reflecting optimism about AI’s transformative potential on a macroeconomic scale.

Broadening the AI Trade Beyond the ‘Magnificent 7’

Historically, AI trade prominence has been concentrated in a select group of mega-cap technology companies often dubbed the “Magnificent 7.” However, 2025 appears to be a year where the AI investment landscape is maturing and diversifying. Strategic analysts expect companies outside this elite group—those involved in AI application development, services, and industrial adoption—to benefit substantially as market recognition grows for AI’s pervasive impact.

This broadening is crucial for sustained growth, as it reduces concentration risk and sparks competition and innovation in more niche or emerging AI sectors. Investors are increasingly looking beyond chip manufacturers and platform providers to include AI integration leaders across industries, creating a more balanced and robust investment ecosystem.

Revenue and Strategic Edge: Ingredients for AI Stock Success Amid Evolving Technology

One consistent theme among the best-performing AI stocks is their ability to either generate revenue directly from AI products and services or gain a strategic advantage through AI integration. Companies that can demonstrate tangible revenue streams tied to AI innovations stand to attract sustainable investor interest, distancing themselves from pure speculative hype.

The focus on monetization and strategic edge ensures that AI hype progresses into measurable business outcomes. Firms leveraging AI to improve customer engagement, optimize operations, or innovate offerings gain competitive advantages that are increasingly recognized in valuations and stock performance.

Impactful Conclusions: AI Stocks at an Inflection Point

The AI stock market’s recent recovery and evolving complexity mark a critical inflection point for investors and industry observers alike. The shift from pure tech platforms and chipmakers to a more diversified set of players spanning industrial applications and productivity-enhancing solutions suggests an expanding narrative about AI’s role in the economy.

Investors poised to capitalize on this trend will need to balance enthusiasm with discernment, focusing on companies with clear revenue models, strategic AI integration, and scalable growth prospects. The AI bull run, reminiscent of past market leadership, appears primed to continue—and perhaps accelerate—propelled by both technological innovation and expanding real-world adoption.

Ultimately, AI’s journey from an exciting concept to a cornerstone of industrial and economic transformation is unfolding in real time, offering both challenges and significant opportunities for those engaged in the AI equity space.