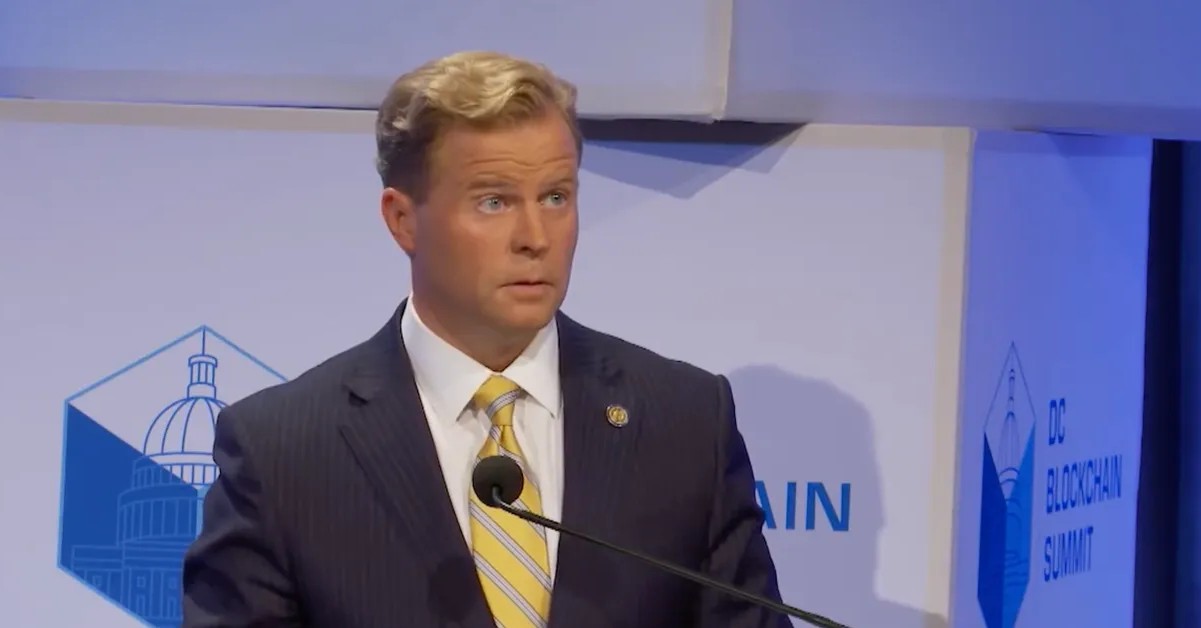

Brian Quintenz’s Nomination to Lead the CFTC: An In-Depth Analysis of His Crypto Ties and Potential Regulatory Impact

As President Donald Trump nominates Brian Quintenz to chair the U.S. Commodity Futures Trading Commission (CFTC), the spotlight has turned firmly on Quintenz’s extensive involvement in the cryptocurrency sector. Quintenz, who previously served as a CFTC commissioner from 2017 to 2021, has disclosed more than $3.4 million in crypto-related assets alongside significant roles in key crypto firms and advocacy groups. This report delves into the implications of his nomination, dissecting his crypto holdings, industry affiliations, and the potential influence he could exert over crypto regulation in the United States.

Quintenz’s Crypto Financial Holdings and Industry Positions

Brian Quintenz’s recent ethics filings, released by the U.S. Office of Government Ethics, reveal an asset portfolio steeped heavily in cryptocurrency investment. His holdings, valued at over $3.4 million, include shares in crypto ventures and funds, notably his involvement with Andreessen Horowitz’s (a16z) crypto arm, where he serves as head of policy. This firm is a prominent venture capital entity specializing in blockchain and crypto startups, positioning Quintenz at the crossroads of policy-making and crypto industry advancement.

Beyond his investment portfolio, Quintenz holds influential advisory and board roles within leading market and crypto firms. His prior tenure as CFTC commissioner furnished him with regulatory insight, while his transition into crypto policy leadership at a16z further cements his embeddedness in the sector. These positions give Quintenz intimate familiarity with market mechanics and emerging blockchain innovations, distinguishing him as a candidate deeply versed in digital asset ecosystems.

The Revolving Door: From Regulator to Industry Advocate and Back

Quintenz exemplifies the “revolving door” dynamic often seen in regulatory bodies, moving from the CFTC to a prominent crypto policy leadership role, and now poised to return as chair of the agency. This trajectory raises questions about potential conflicts of interest and regulatory capture, particularly amid his substantial crypto assets.

However, Quintenz has pledged to recuse himself from matters where conflicts arise and committed to divesting relevant holdings upon confirmation. This offers a measure of assurance regarding transparency and ethical compliance, though industry and public scrutiny will inevitably persist given his entwined history with both market regulation and crypto advocacy.

Potential Influence on Crypto Regulation Under Quintenz’s Leadership

The CFTC’s role in overseeing commodity derivatives extends increasingly into the realm of digital assets, especially cryptocurrencies that qualify as commodities under U.S. law. Quintenz’s deep crypto industry experience suggests he may push for regulatory frameworks that not only safeguard market integrity but also promote innovation and adoption within the digital asset space.

His leadership could accelerate the CFTC’s efforts to clarify jurisdictional authority over crypto derivatives and spot markets. For example, he has previously highlighted the need to delineate enforcement capabilities, emphasizing regulatory priorities that balance investor protection with technological progress. As chair, Quintenz is likely to leverage his familiarity with crypto market dynamics to influence policy initiatives favoring industry growth while maintaining oversight.

The Industry Perspective: Enthusiasm and Cautious Optimism

Crypto industry stakeholders have generally reacted positively to Quintenz’s nomination, viewing him as a “crypto-friendly” figure who understands the technology and business models behind blockchain innovation. His role at a16z, a pillar in crypto venture capital, signals a potential willingness to engage with new digital asset products, fostering a more conducive environment for enterprise and institutional investment.

At the same time, regulators and analysts emphasize the importance of maintaining a balance between promoting innovation and preventing bad actors. The CFTC under Quintenz will face challenges navigating these competing demands, especially as digital currencies and derivatives grow in complexity and scale.

Challenges Facing CFTC and Crypto Regulation

In addition to regulatory hurdles, the CFTC under Quintenz confronts internal agency reshuffles, with multiple commissioners exiting and a reorganization underway. These structural shifts come at a time when the crypto landscape is rapidly evolving, demanding agile and informed regulatory responses.

Moreover, legal ambiguities persist concerning the extent of CFTC jurisdiction over certain crypto assets, particularly spot trading markets which have historically fallen outside the agency’s enforcement authority. Quintenz’s expertise may be crucial in advocating for expanded or clarified regulatory powers to address these gaps.

Finally, public and political scrutiny over regulators’ impartiality will intensify given Quintenz’s personal financial exposure to crypto. His success as CFTC chair will depend in part on his ability to demonstrate clear ethical boundaries and deliver balanced regulatory outcomes.

Conclusion: A Pivotal Appointment for Crypto Regulation in the U.S.

Brian Quintenz’s nomination to lead the Commodity Futures Trading Commission carries profound significance for the future of cryptocurrency regulation. His multifaceted involvement—ranging from previous regulatory experience to crypto venture policy leadership and considerable personal investment—positions him uniquely at the nexus of governance and innovation.

If confirmed, Quintenz could champion policies conducive to blockchain technology advancement within a robust regulatory framework, potentially accelerating institutional adoption and legitimization of digital assets in the U.S. economy. Nonetheless, the ethical and perceptual challenges posed by his disclosed crypto holdings will require careful navigation to maintain public trust and regulatory credibility.

In this critical juncture for U.S. crypto policy, Quintenz’s leadership may not only define the trajectory of the CFTC itself but also influence global standards in digital asset oversight, setting precedents for how emerging financial technologies can be effectively managed in a rapidly transforming marketplace.