Nvidia’s Latest Earnings: A Resounding Surge Amid Evolving Market Sentiment

Nvidia’s recent financial disclosures have reignited interest across the investment community, prompting analysts to raise price targets amid an impressive quarter fueled by surging AI demand. The fiscal fourth quarter of 2025 saw Nvidia delivering a revenue leap that not only beat expectations but also set a robust stage for fiscal 2026 outlook discussions. Yet, beneath this upbeat veneer lies a nuanced narrative balancing stellar performance and cautionary guidance tempered by market headwinds.

Breaking Down the Quarter: Numbers That Speak Volumes

Nvidia reported a blockbuster quarter ending January 26, 2025, with revenue hitting $39.3 billion — a 12% increase from the prior quarter and a staggering 78% year-over-year jump. This growth, notably driven by the data center division which alone surged 112% to approximately $30.77 billion, underscored Nvidia’s dominant position in the artificial intelligence chip market. Continued investments from cloud providers to expand generative AI infrastructure significantly contributed to this robust revenue performance.

Adjusted gross margins settled at 75%, reflecting some pressures on profitability but still marking a strong operational performance in a complex supply-demand environment. The quarter’s earnings beat consensus Wall Street expectations, feeding optimism about Nvidia’s ability to capitalize on AI’s transformative momentum.

Analyst Sentiment: A Wave of Price Target Upgrades

Following the earnings release and guidance presentation, a wave of analysts raised their Nvidia price targets. For instance, Timothy Arcuri of UBS adjusted his target slightly downward from $180 to $175, maintaining a “Buy” rating with an implied upside of approximately 32%. Other firms, factoring in Nvidia’s sustained growth and new contract announcements, pushed price targets even higher, some envisioning more than 50% upside over current share prices.

The enthusiasm stems largely from Nvidia’s early innings in AI, where the company’s leadership in AI chip architecture positions it to benefit enormously from expanding technology adoption across industries. Analysts see Nvidia not only as a chipmaker but as an innovation engine powering next-generation AI deployments.

Guidance and Market Realities: The Mixed Signals

Nvidia’s fiscal 2026 second-quarter guidance introduced a note of cautious realism. The company projected revenue approximately at $45 billion, plus or minus 2%, slightly below the consensus expectation of $45.9 billion. This guidance prompted some investor skepticism and share price volatility despite the strong quarterly results.

Contributing to the tempered outlook are external factors such as export restrictions on Nvidia’s latest H20 chips to China, potentially resulting in $15 billion in lost revenue. The impact of geopolitical tensions, tariffs, and supply chain dynamics also casts a shadow over near-term prospects, making Nvidia’s path forward more complex than the headline numbers suggest.

Strategic Drivers: AI, Cloud Expansion, and Developer Ecosystems

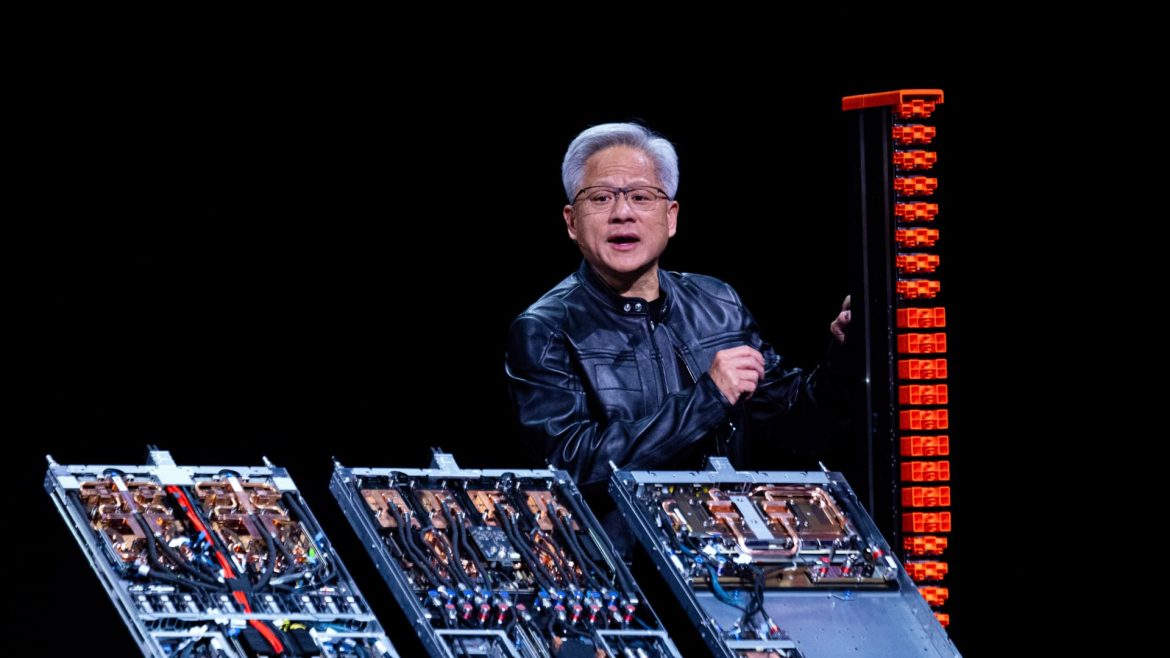

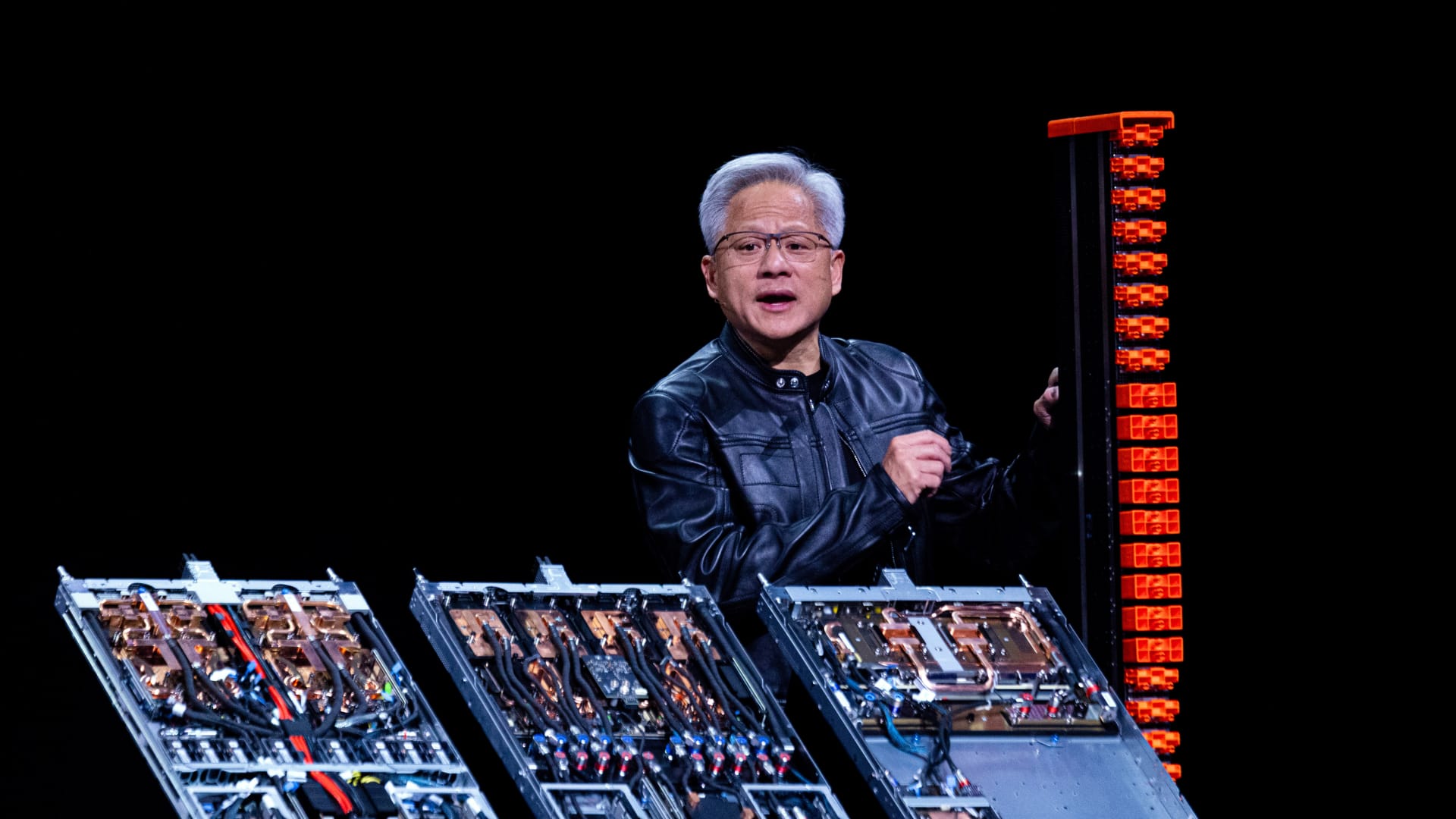

At the heart of Nvidia’s growth story is its deep entrenchment in AI workloads powering cloud computing and generative AI applications. The company reported an expanding universe of developers leveraging its platforms, which CEO Jensen Huang emphasized as foundational to the firm’s accelerating momentum.

Moreover, sustained investments by cloud service providers to scale infrastructure fuel ongoing demand for Nvidia’s data center chips. These trends underpin expectations that Nvidia is not merely riding a short-term cycle but is integral to a structural shift in computing paradigms.

Challenges and Considerations: Profitability and Market Expectations

While the revenue and earnings beat were celebrated, some nuances reflect underlying challenges. Gross margin compression to 75% hinted at margin pressures possibly arising from inventory charges (notably a reported $5.5 billion charge related to H20 chip inventory and reserves), competitive pricing, and operational costs linked to ramping new technologies.

Additionally, Nvidia’s historically high expectations set a tough bar each quarter; as noted by market commentators, even a “beat and raise” quarter can trigger selling if future guidance falls short of exuberant investor forecasts. This dynamic exposes Nvidia’s stock price to volatility, emphasizing the delicate balance between innovation-driven optimism and realistic growth pacing.

Technical and Market Performance: Navigating the Volatility

Streaming into the market’s technical perspective, Nvidia’s recent price action shows a consolidation phase with notable resistance and support levels observed around the $130–$145 range. Options traders anticipate a 7.7% swing post-earnings, suggesting heightened volatility.

Despite these fluctuations, longer-term technical analysis remains cautiously positive, though some ratings shifted to “Hold” on valuation grounds, emphasizing expected compound annual growth rates below broader market indices.

The Road Ahead: Early Innings of AI, Long-Term Potential

Nvidia’s current performance and guidance depict a company benefiting from enormous secular tailwinds in AI but confronted by short-term geopolitical and market challenges. The dominant view among analysts is that Nvidia remains in the early stages of a long AI cycle, with broad potential upside even if near-term quarters require managing headwinds.

Strategic partnerships (such as recent announcements involving Saudi investments and collaborations with hardware manufacturing giants like Foxconn) could further bolster Nvidia’s growth horizon. Meanwhile, the evolving regulatory landscape, especially export controls affecting China, remains a critical variable to monitor.

Conclusion: Nvidia’s Balancing Act Between Exceptional Growth and Market Realities

Nvidia’s latest quarterly results firmly establish its prowess as a premier AI chipmaker and innovation engine, underscored by extraordinary revenue growth and strong market demand. The company’s expanding role in powering cloud computing and generative AI ecosystems sets it up for significant long-term rewards.

However, investors and analysts alike must weigh this brilliance against cautionary factors, including export restrictions, margin pressures, and elevated market expectations that temper immediate enthusiasm. This interplay creates a nuanced outlook that calls for measured optimism: Nvidia’s journey is not just a sprint but an extended marathon in shaping the future of computing.

As the AI revolution unfolds, Nvidia stands poised to navigate the complexities ahead, making it a marquee stock for those seeking exposure to cutting-edge technology with the understanding that market cycles and geopolitical forces will inevitably influence near-term performance. The balance of stellar execution and strategic foresight will define Nvidia’s trajectory in the years to come.