Nvidia’s China Market Share Erosion Amid U.S. Chip Export Controls: A Comprehensive Analysis

Introduction

Nvidia, a leading global provider of graphics processing units (GPUs) central to artificial intelligence (AI) innovation, has recently faced significant challenges in its China business. Over the past four years, escalating U.S. government export restrictions targeting advanced semiconductor technology have profoundly impacted Nvidia’s market share in China, cutting it nearly in half—from approximately 95% down to 50%. This drastic decline offers a case study into how geopolitical tensions, trade policies, and technological competition intertwine to reshape the global semiconductor industry landscape. Nvidia’s CEO Jensen Huang has openly criticized these U.S. chip export controls, labeling them a “failure” that inadvertently accelerates China’s domestic chip development and harms American companies’ competitiveness.

The Structure and Rationale Behind U.S. Chip Export Controls

The U.S. government, driven by concerns of national security and technological leadership, imposed stringent controls on exporting advanced AI-capable chips, particularly Nvidia’s H100 and H20 series, to China. The rationale centers on preventing these powerful chips from enabling capabilities perceived as beneficial to China’s military or surveillance programs. By restricting U.S. firms from selling cutting-edge semiconductors to Chinese companies, Washington aimed to slow China’s AI progress and maintain American technological dominance.

However, these controls have been broad and restrictive. Not only have they mandated special licensing and outright bans on high-end chip sales, but they have also complicated business operations and limited revenue from the sizeable Chinese market, worth around $50 billion. Nvidia has publicly stated that it left $2.5 billion in revenue “on the table” during a recent quarter due to these restrictions.

Market Share Impact and Huang’s Criticism

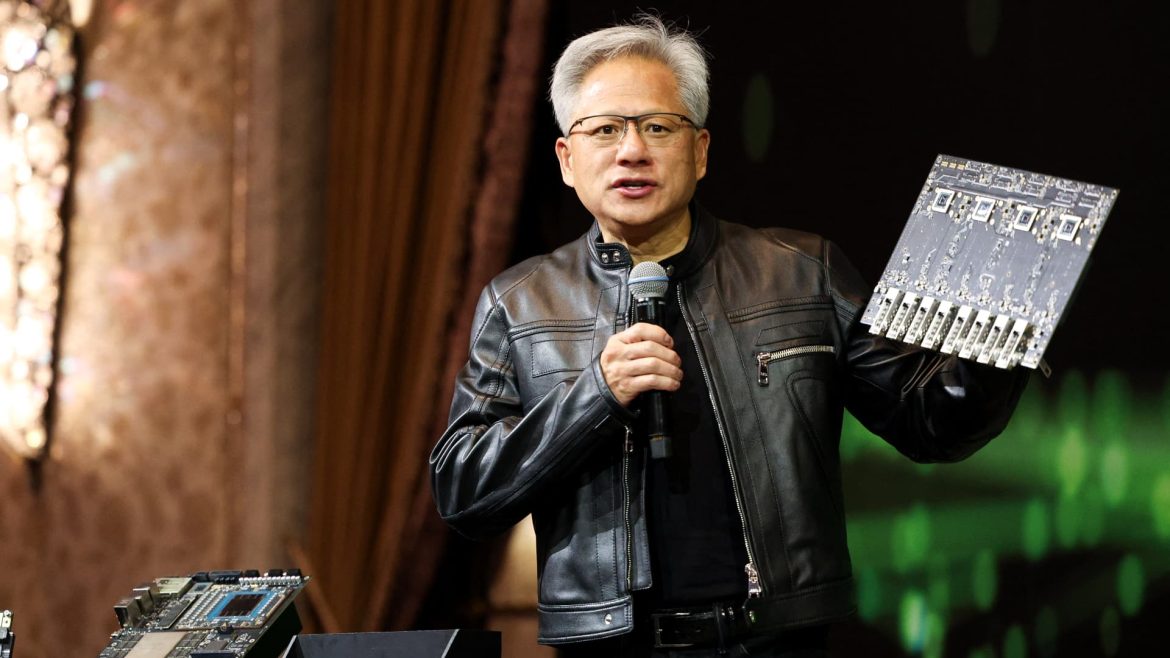

Jensen Huang, often described as visionary in AI hardware development, has been candid in his assessment of the policy’s outcomes. At recent industry events such as the Computex technology show in Taipei and in interviews with global media, Huang stated that the export controls have “effectively closed” Nvidia’s Chinese market. His analysis emphasizes the dramatic market share fall from 95% four years ago to 50% currently, underscoring the enormous competitive disadvantage imposed by the restrictions.

Huang further frames the controls as a strategic misstep because they incentivize Chinese engineers and companies to accelerate development of homegrown AI chips, reducing China’s reliance on foreign technology. He warns that if U.S. policymakers do not reconsider the approach, American firms risk losing not only the large Chinese market but also their edge in the global AI race.

Chinese Chip Development and Market Dynamics

Chinese semiconductor companies, such as those backed by government-driven initiatives, have gained pace in developing AI-capable chips. The export ban on advanced Nvidia GPUs effectively has been a forced catalyst for this growth. Huang’s remarks highlight that China is “not behind” in AI capabilities, reflecting rapid strides domestically as a direct consequence of trade restrictions.

China’s response includes deploying pilotless planes and other autonomous systems powered by indigenous chips. Nvidia attempts to maintain a foothold by introducing modified, less powerful versions of its H20 AI chips for China, circumventing some restrictions but conceding performance and market share.

Implications for Nvidia and the Broader Industry

Nvidia’s challenges illuminate a wider dilemma in the semiconductor and AI sectors: balancing geopolitical strategy with economic and technological interests. While the U.S. controls sought to protect national security, the fallout suggests a loss of significant revenue and market presence for leading American tech firms. Other major chipmakers, such as AMD, also reportedly face revenue declines due to similar restrictions.

The curbs create risks of fragmentation in the global semiconductor ecosystem, with China developing parallel supply chains and technology bases that might reduce interoperability and increase long-term competition. The acceleration of China’s AI chip capabilities could shift the balance of power in global technology leadership in the medium to long term.

Calls for Policy Reevaluation

Nvidia’s leadership and many industry analysts urge a recalibration of U.S. chip export policies. Huang’s public declarations that the controls are a “failure” seek to influence policymakers to ease restrictions, arguing that maintaining collaboration and sales in China is vital to sustaining American innovation leadership and economic vitality.

The Biden administration reportedly is reviewing and planning adjustments to export control rules. The Trump administration also indicated plans to revise certain curbs. Such moves aim to strike a better balance, enabling U.S. companies to serve major markets like China while safeguarding strategic interests.

Conclusion: Navigating Complex Geopolitics and Technology Competition

Nvidia’s stark loss of China market share amid U.S. chip export restrictions embodies a complex strategic paradox—efforts to contain adversaries through controls have inadvertently sowed competitive disadvantages to American firms and accelerated the targeted competitor’s indigenous technological growth. Jensen Huang’s forthright critiques highlight the unintended consequences of well-intentioned policies that constrain U.S. economic opportunities and technology leadership.

Going forward, achieving a nuanced approach that protects national security without undermining commercial competitiveness or empowering rivals’ self-reliance will be crucial. Nvidia’s experience offers valuable lessons in how global tech supply chains, government policy, and innovation ecosystems are deeply interconnected in today’s geopolitical landscape. The outcome of this evolving situation will shape not only Nvidia’s future but the trajectory of AI development and semiconductor dominance worldwide.