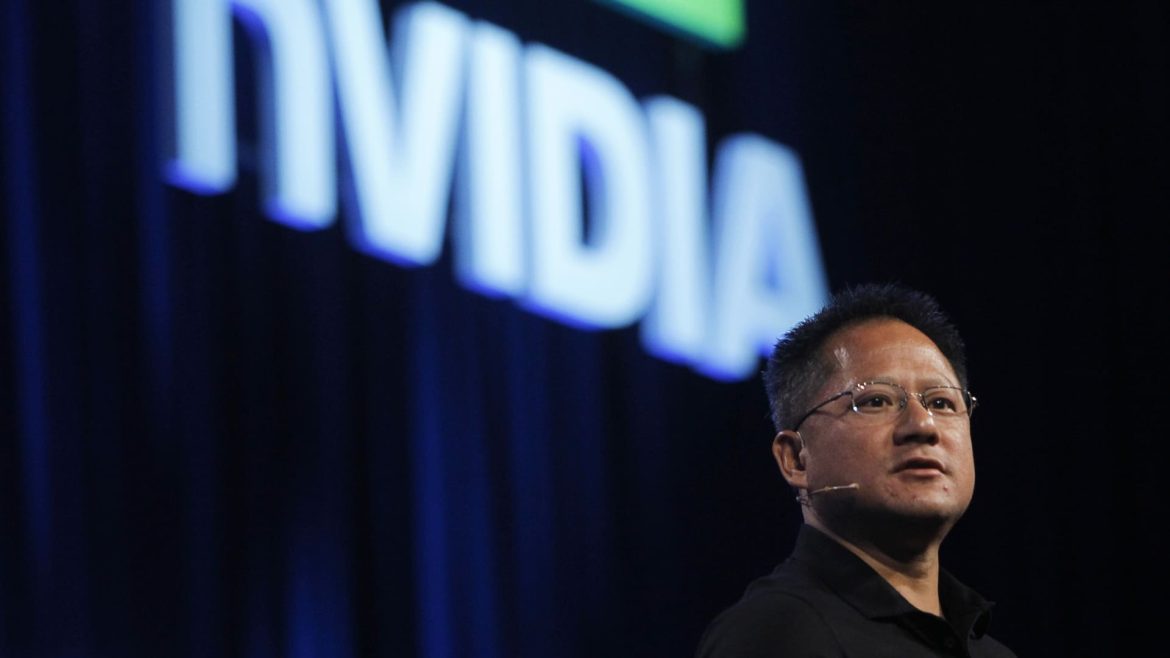

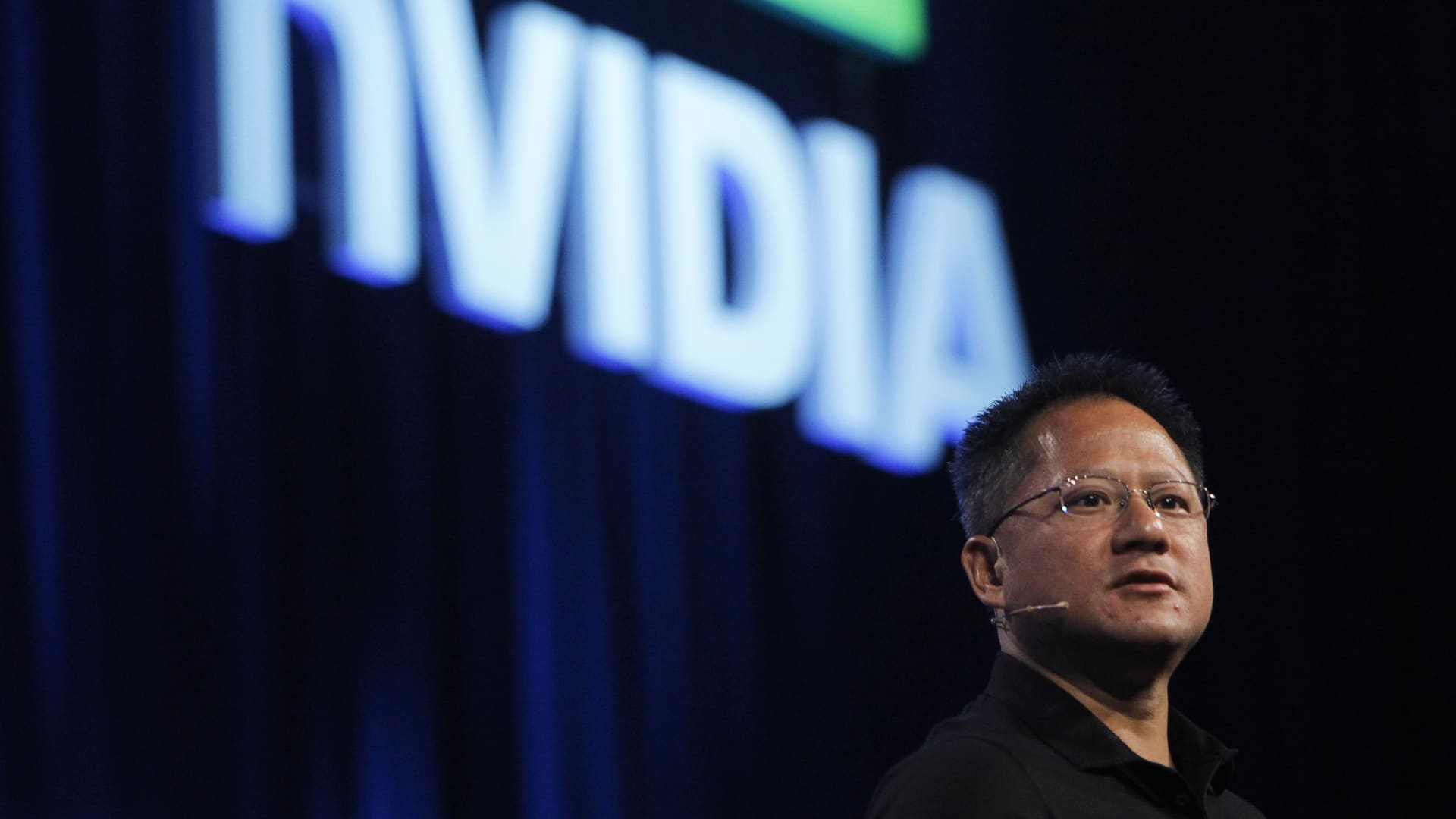

The Astonishing Growth of a $1,000 Investment in Nvidia Over the Past Decade

Investing in the stock market has long been a pathway to creating wealth, but few stories are as compelling as the rise of Nvidia Corporation’s stock over the past 10 years. Whether you’re a seasoned investor or just curious about tech stocks, examining Nvidia’s growth journey through the lens of a $1,000 investment made a decade ago reveals both the power of innovation and why this company has captivated the market.

Nvidia’s Growth in Numbers: From $1,000 to Over $200,000+

Across multiple analyses and data points, the picture is striking: a $1,000 investment in Nvidia stock anywhere from 2014 to 2015 would be worth between $145,000 to nearly $300,000 as of early 2025, depending on the exact date and inclusion of dividends. This translates into:

– Percentage gains between approximately 22,000% to 30,000% over 10 years.

– In literal terms, an initial $1,000 ballooned to somewhere between $145,000 and $297,000 based on estimates from financial data platforms like Morningstar Direct, YCharts, CNBC, and others.

– Factoring in reinvested dividends further pushes the value higher, with some calculations reaching upwards of $277,000.

These estimates contrast modestly due to differing time points of the initial investment (mid-2014 versus early 2015) and calculation methodologies (including dividend reinvestment or not), but all highlight extraordinary amplification of capital.

Early Comparisons: Nvidia’s Public Debut and Longer-Term Results

For context, Nvidia went public in 1999. If you had invested $1,000 at that time, some reports suggest you would be sitting on more than $5 million today, an astronomical return powered by steady innovation and market leadership in graphics processing units (GPUs).

More recent 20-year outlooks cite a $1,000 stake becoming nearly a million dollars, emphasizing Nvidia’s sustained growth over two decades.

What Drove This Explosive Growth?

The impressive returns on Nvidia stock reflect the company’s strategic positioning in several high-growth technology sectors:

Investment Lessons from Nvidia’s Decade-Long Surge

The Power of Long-Term Holding

The dramatic multi-thousand percent gains emphasize the virtue of patient long-term investing, especially in tech leaders with sustainable competitive advantages.

Diversification Still Matters

Nvidia’s story is appealing, but replicating such returns is difficult. Holding a diversified portfolio to mitigate sector-specific risks remains prudent.

Dividends Add Value

Though Nvidia’s dividend yields are relatively modest, reinvesting them notably boosts returns over time, as demonstrated by some estimates.

Market Timing and Entry Points Vary Return Magnitudes

Even within a 10-year window, the exact timing of investment (mid-2014 versus early 2015) can materially influence ultimate gains by tens of thousands of dollars. This highlights the role of market cycles and the importance of strategic entry points.

Conclusion: Nvidia’s Investment Trajectory as a Testament to Innovation and Timing

Investing $1,000 in Nvidia just a decade ago could have transformed into nearly a quarter million dollars or more today—proof of the profound impact technological innovation and visionary leadership wield over wealth creation. This story underscores how identifying industry front-runners early and committing to long-term horizons rewards investors far beyond typical market returns.

For those seeking inspiration or considering tech investments, Nvidia’s historic run offers a vivid case study in vision, execution, and the compounding magic of time paired with groundbreaking technology advancement.