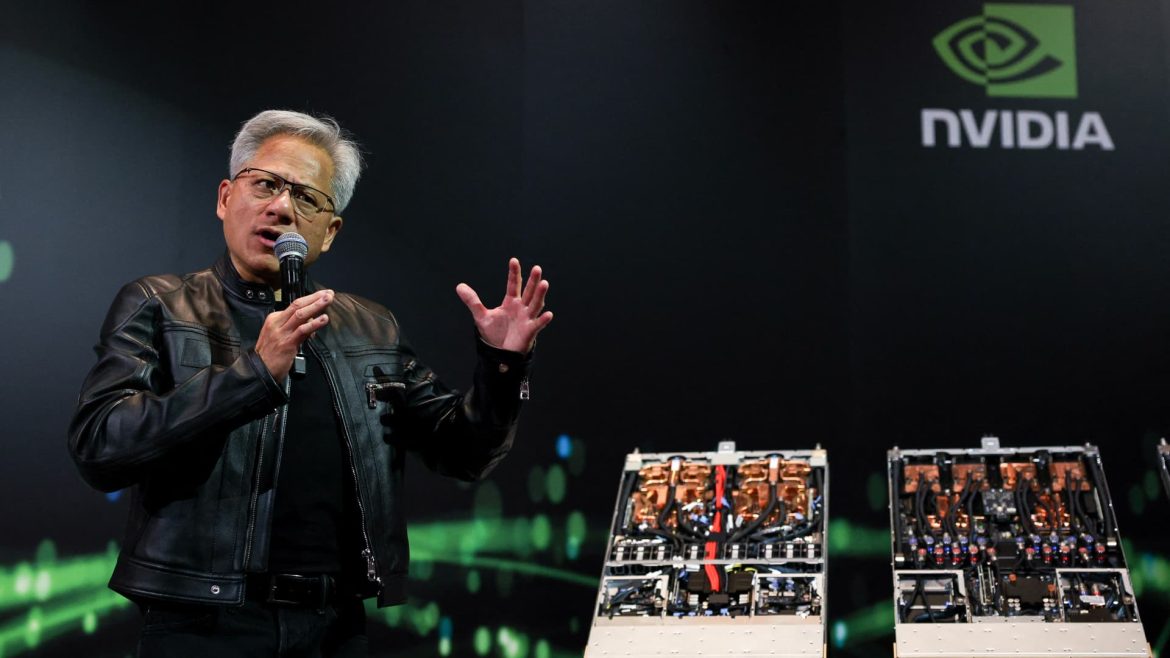

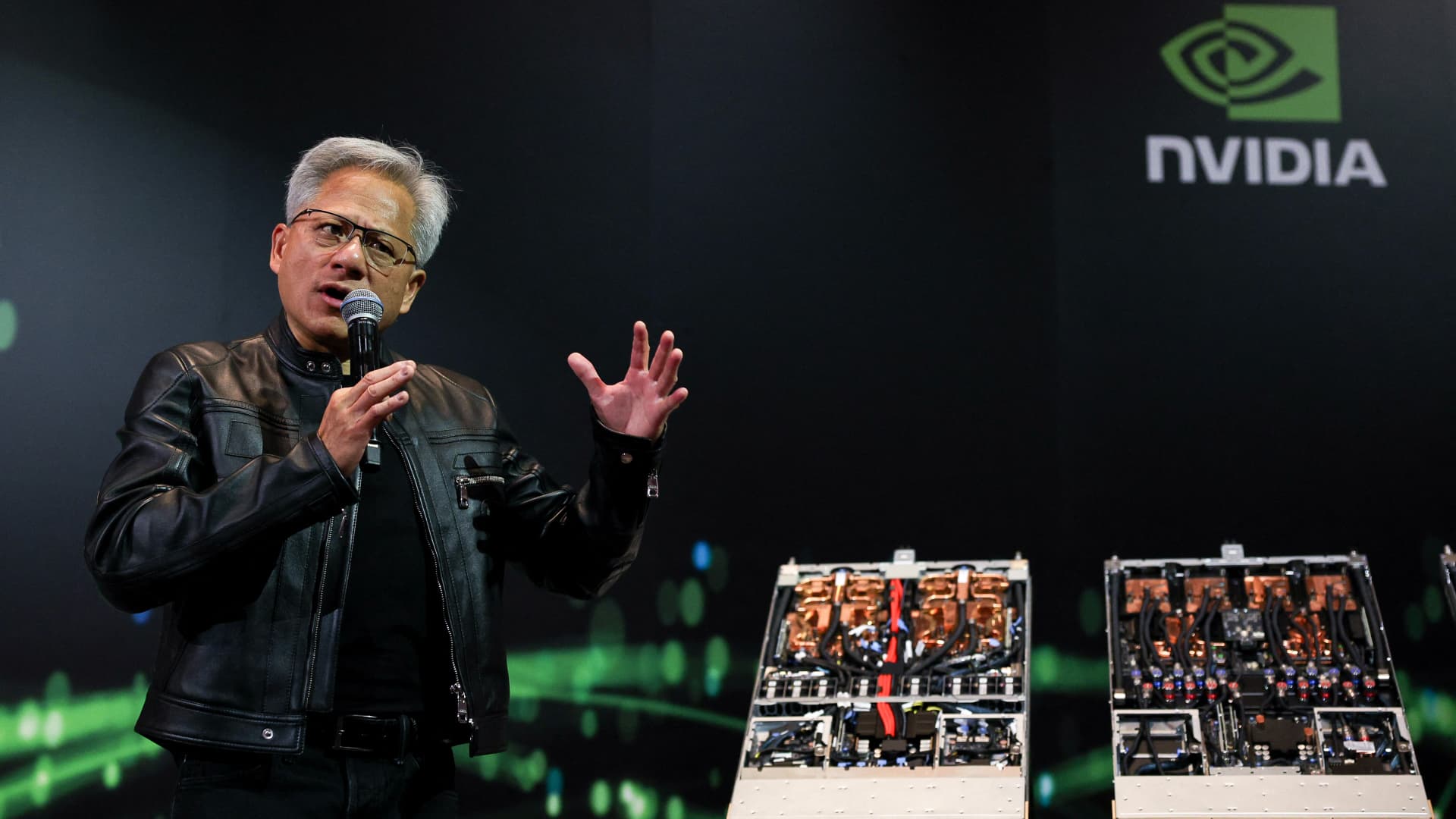

Navigating the Crossfire: Nvidia’s Challenges Amid US-China Tech Tensions

The global semiconductor landscape has become a battleground between the United States and China, with Nvidia—a dominant American chipmaker—caught precariously in the middle. Recent developments involving antitrust investigations, export restrictions, and hefty financial charges exemplify how geopolitical frictions extend far beyond diplomatic realms, deeply impacting international business operations and market dynamics.

—

The Core of China’s Antitrust Investigation into Nvidia

China’s State Administration for Market Regulation (SAMR) launched a formal antitrust probe into Nvidia, scrutinizing alleged violations of the country’s anti-monopoly laws. Central to the investigation are:

– Allegations of Unlawful Market Practices: These include forced product bundling, unreasonable trade terms, and purchase restrictions imposed on customers or partners within China.

– Mellanox Technologies Acquisition Review: Nvidia’s 2020 acquisition of Mellanox is under the scanner for compliance issues, suggesting that the probe extends beyond immediate sales practices to past mergers and acquisitions agreements.

This scrutiny emerges in a larger context: China appears to be responding to the tightening U.S. export controls on Nvidia’s advanced AI chips, which it views as a strategic move to stifle its semiconductor ambitions.

—

Financial Implications: The $5.5 Billion Charge and Potential Fines

Nvidia is bracing for a significant financial hit in the first quarter, anticipating a $5.5 billion charge tied directly to the U.S. government’s clampdown on AI chip exports to China. These restrictions severely limit the sale and distribution of cutting-edge chip models, such as the highly capable H100, effectively curtailing Nvidia’s growth prospects in one of the world’s largest semiconductor markets.

Adding to the financial stress is the prospect of a penalty levied by Chinese regulators that could reach as high as US$1.03 billion—equivalent to 10% of Nvidia’s annual China sales. Such a fine underscores the Chinese government’s determination to enforce its antitrust laws strictly, especially in technology sectors deemed critical for national security and economic sovereignty.

—

The Ripple Effect: Market Response and Strategic Adjustments

Investors have reacted sharply to the unfolding saga, as Nvidia’s stock price dropped amidst concerns over sales cancellations tied to U.S. trade restrictions and escalating regulatory risks. Reportedly, several billion dollars of pending orders in China might be scrapped, signaling a potentially severe contraction in market demand driven by geopolitical forces rather than pure commercial factors.

In response, Nvidia has attempted to navigate the regulatory maze by:

– Developing China-Specific Chip Variants: The introduction of the H20 chip, designed to comply specifically with Chinese and U.S. restrictions, illustrates a strategic pivot to maintain a foothold in China’s complex tech ecosystem. However, this adaptation poses challenges in terms of performance parity and operational complexity.

– Regulatory Engagement and Legal Defenses: Nvidia disputes allegations from the antitrust investigation, suggesting a vigorous defense aimed at mitigating fines and operational constraints while seeking to preserve long-term access to Chinese markets.

—

Broader Context: The US-China Semiconductor Technology Rivalry

Nvidia’s situation is emblematic of the wider tech tensions between the U.S. and China. Export controls instituted by the U.S. aim to slow China’s technological advancement by restricting access to state-of-the-art semiconductor components. In retaliation, China’s rigorous enforcement of antitrust laws against U.S. companies like Nvidia can be interpreted as a leverage tactic within these ongoing “chip wars.”

This interplay raises critical issues:

– Global Supply Chain Disruptions: Multinational chipmakers face complex compliance challenges, needing to tailor product lines and commercial strategies to adhere simultaneously to divergent regulatory regimes.

– Market Fragmentation Risks: The divergence in technology standards and export restrictions threatens to fragment global semiconductor markets, forcing companies to adopt bifurcated strategies instead of universal ones.

– Innovation and Competitiveness: Both nations risk undermining global innovation momentum if supply chain uncertainties and market access barriers persist and intensify.

—

Strategic and Industry Lessons for Nvidia and Peers

Nvidia’s case highlights several key strategic lessons for semiconductor firms operating amid geopolitical rivalry:

—

Conclusion: Nvidia’s Tightrope Walk in a Divided Tech World

Nvidia’s challenges at the intersection of U.S.-China relations paint a vivid portrait of how geopolitics now decisively influence the tech industry’s fortunes. The antitrust probe in China, combined with U.S. export restrictions and significant financial repercussions, requires Nvidia to tread carefully—balancing compliance, innovation, and market access.

The company’s ability to adapt through tailored technology offerings and active regulatory engagement will shape its future trajectory in China and beyond. Yet, more broadly, Nvidia’s case serves as a cautionary tale of how global semiconductor companies must navigate a fractured political landscape where business decisions are inseparable from geopolitics. In this evolving landscape, agility, strategic foresight, and resilience are not just competitive advantages—they are survival tools.