Cigna’s Strategic Moves to Address the Rising Costs of Weight-Loss Drugs

Introduction

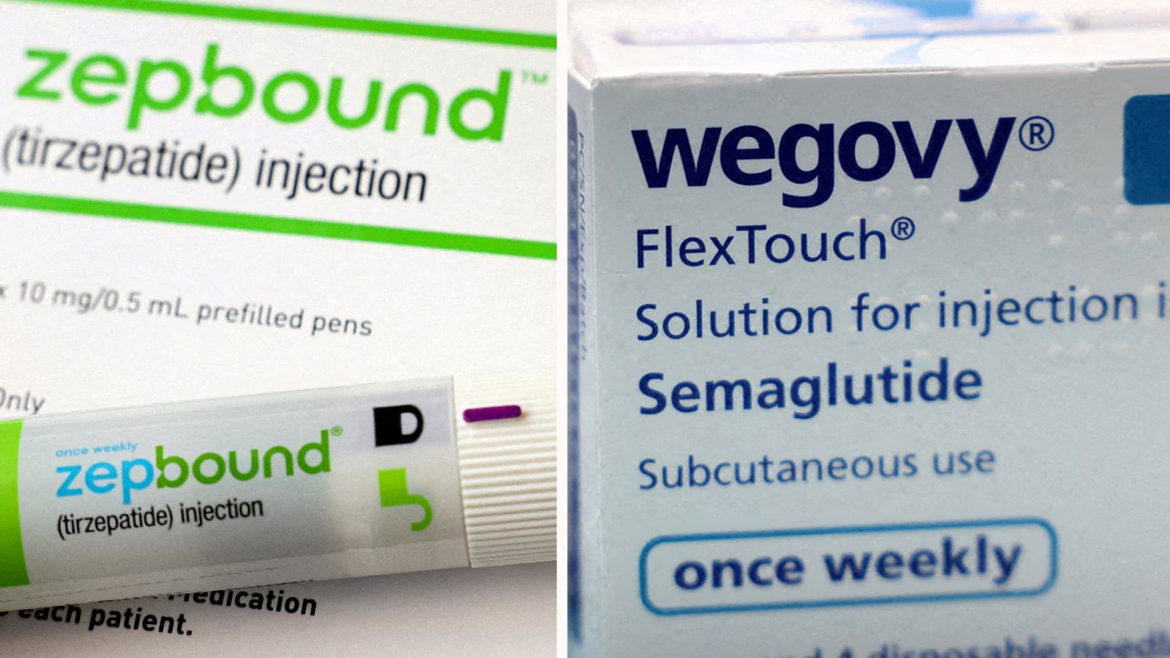

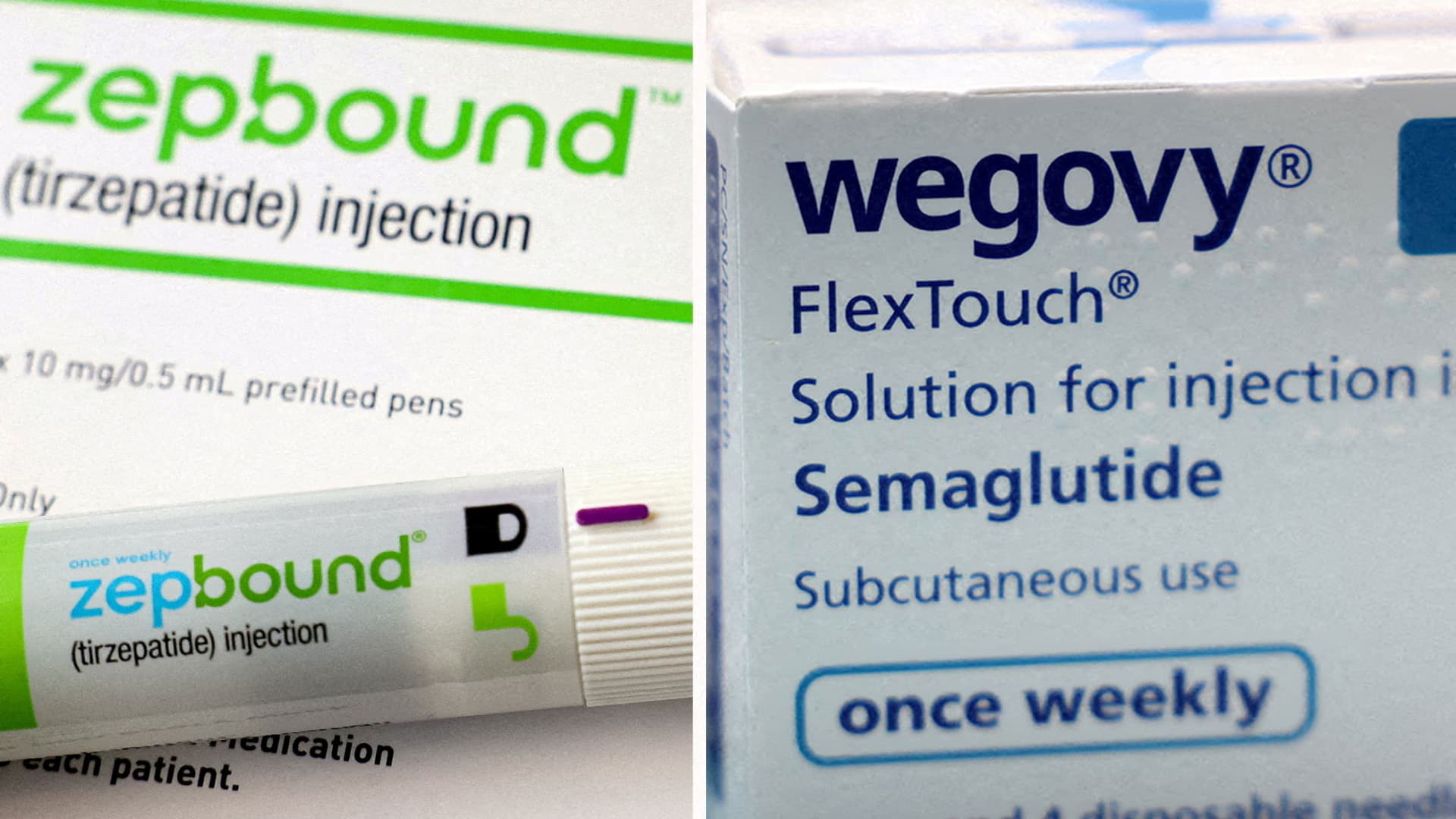

The prevalence of obesity and related health conditions has driven significant demand for effective weight-loss medications, particularly glucagon-like peptide-1 receptor agonists (GLP-1s), such as Novo Nordisk’s Wegovy and Eli Lilly’s Zepbound. These treatments, while promising, come at a high cost, often reaching up to $1,000 per month, translating to approximately $15,000 annually per patient. This pricing challenge poses a dilemma for health insurers, employers, and patients alike, prompting innovations in coverage and cost management strategies. Cigna, a leading health service organization with a strong pharmacy benefits management (PBM) arm, has emerged at the forefront of addressing these concerns by striking deals and implementing novel cost-containment programs. This analysis explores Cigna’s initiatives aimed at expanding access to weight-loss drugs while capping financial burdens on health plans and insured individuals.

Cigna’s Novel Agreements with Drug Manufacturers

Cigna’s PBM unit has secured agreements with the two dominant GLP-1 drug manufacturers, Novo Nordisk and Eli Lilly, specifically targeting Wegovy and Zepbound. Central to these arrangements is a 15% annual cap on price increases for these weight-loss medications. This mechanism ensures that employer-sponsored health plans and insurers participating in Cigna’s network can better predict and manage expenditures, reducing the risk of runaway cost escalations common in pharmaceutical markets.

By limiting drug price inflation through these capped agreements, Cigna alleviates one of the main barriers to broader insurance coverage for GLP-1 therapies — the fear of unsustainable cost growth. In turn, these deals create a financial climate where health insurers and employers are more inclined to include these medications in their formularies, expanding patient access without disproportionate financial exposure.

Impact on Patient Out-of-Pocket Costs

Beyond curbing health plan expenses, Cigna has introduced initiatives aimed directly at reducing patients’ financial burdens. For example, its Evernorth subsidiary launched programs that cap patient copayments for Wegovy and Zepbound at $200 per month. Considering that cash prices for these drugs sold directly to consumers by manufacturers can exceed $499 monthly, this copay cap effectively halves the out-of-pocket cost for insured individuals. Such affordability provisions can significantly enhance patient adherence and treatment uptake, essential aspects for chronic conditions like obesity where sustained therapy yields the best outcomes.

These patient-focused cost caps represent a competitive advantage for Cigna’s health plans, as they combine broader pharmaceutical coverage with affordable access, potentially improving member satisfaction and health outcomes.

Addressing Employer and Insurer Concerns

Employers, who frequently sponsor health plans for their workforce, have expressed alarm over skyrocketing drug costs, particularly for novel therapies like GLP-1 weight-loss drugs. Cigna’s agreements address such concerns through cost predictability and financial guarantees that restrain the growth of pharmacy expenses related to these drugs.

Moreover, these arrangements serve as a proactive response against potential plan exclusions of weight-loss drugs due to cost, ensuring that coverage remains comprehensive yet financially viable. By stabilizing drug spending and controlling out-of-pocket copays, Cigna maintains a balance between patient access and cost containment, enhancing the attractiveness and sustainability of its insurance offerings.

Market and Competitive Context

The high demand for weight-loss GLP-1 drugs has triggered intense competition between manufacturers and pharmacy benefit managers (PBMs). Eli Lilly and Novo Nordisk dominate the space, each aggressively pursuing market share through pricing strategies, direct-to-consumer programs, and telehealth partnerships. Cigna’s initiatives fit into this evolving landscape by partnering directly with these manufacturers, reflecting a trend where PBMs use strategic deals to influence pricing and coverage models.

This competitive ecosystem also includes new entrants and alternative therapies, potentially pressuring prices and encouraging value-based agreements. Cigna’s strategy, with its focus on capping price increases and out-of-pocket costs, positions the company to navigate these shifts effectively, preserving its market relevance and appeal to insurers, employers, and patients.

Broader Implications for Healthcare

Cigna’s approach exemplifies a pragmatic middle path in confronting the challenges posed by expensive, high-demand drugs. By instituting spending caps and patient copay limits, the company aims to broaden access to effective weight-loss treatments while containing overall healthcare spending growth. Such models could serve as templates for managing costs of other costly specialty drugs, fostering sustainable innovation adoption in the healthcare system.

Conclusion: A Model for Sustainable Weight-Loss Drug Accessibility

Cigna’s comprehensive agreements with Novo Nordisk and Eli Lilly set a pioneering example in tackling the dual challenges of cost and access in the weight-loss drug market. Through annual price increase caps and patient copay limits, Cigna not only mitigates financial risks for health plans and employers but also reduces barriers for patients seeking GLP-1 therapies. This balanced strategy addresses the pressing need for obesity treatments amid soaring public interest while promoting fiscal responsibility and equitable access.

As demand for weight-loss drugs continues to rise, Cigna’s initiatives underscore the vital role that innovative insurance design and collaborative manufacturer partnerships play in shaping the future of healthcare affordability and accessibility. This approach offers a promising pathway to integrate breakthrough therapies into mainstream care without exacerbating cost burdens for stakeholders across the system.