Navigating the Midday Stock Market Surge: Key Movers and Underlying Dynamics

Stock markets embody a complex interplay of innovation, investor sentiment, and broader economic forces. Midday trading sessions often reveal the undercurrents moving certain shares dramatically, painting a real-time snapshot of shifting investor priorities. Recently, the markets have spotlighted major movers including D-Wave Quantum, Moderna, Agilysys, and Tesla, each driven by distinct catalysts yet collectively shaping the evolving financial landscape.

—

D-Wave Quantum: Quantum Computing Takes Center Stage

The most eye-catching story comes from D-Wave Quantum (QBTS), whose shares surged over 20% in morning trading and have advanced an impressive 56% in 2025 alone. This meteoric rise is not happenstance but rooted in substantive technological breakthroughs and bullish market expectations.

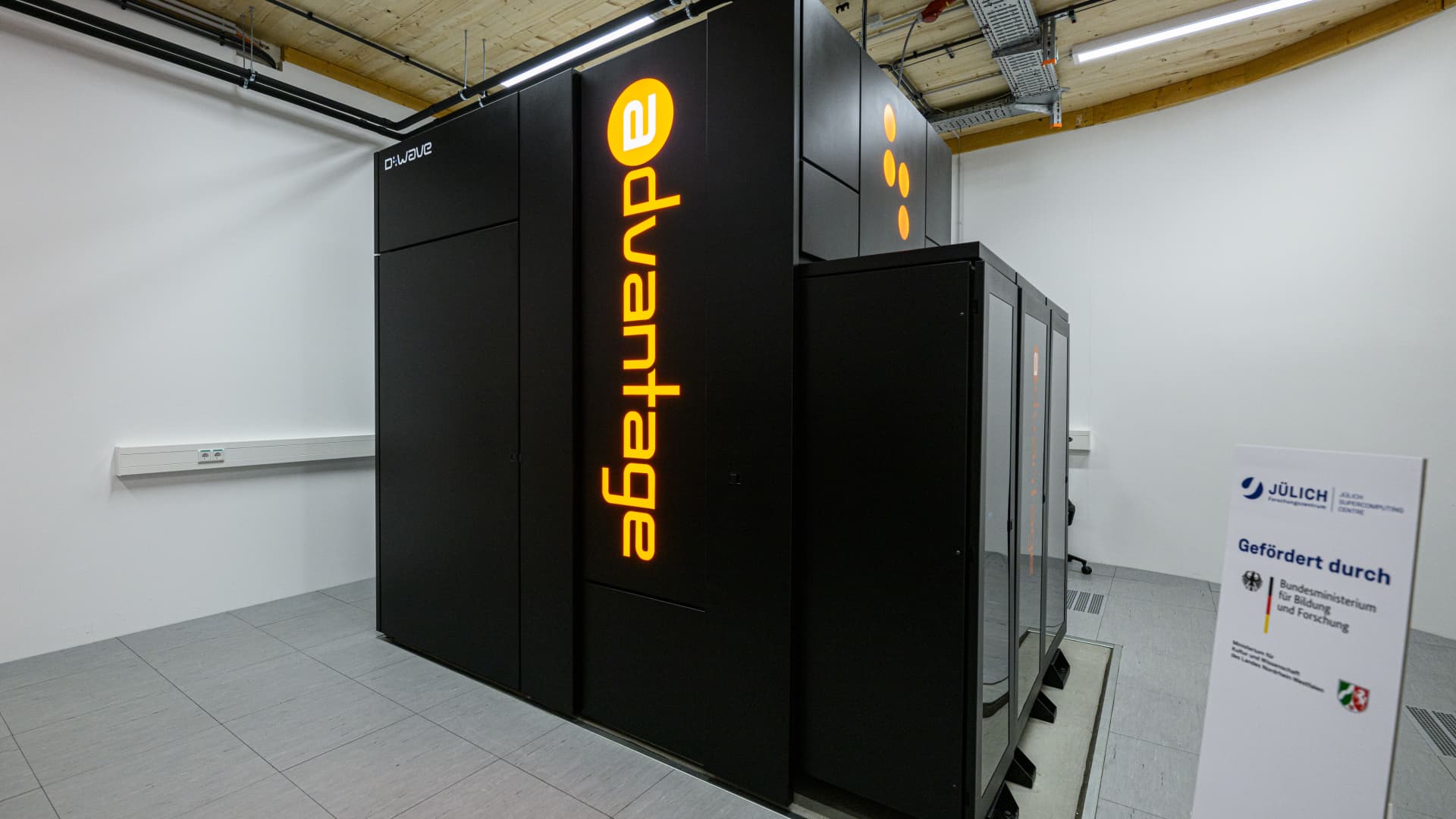

– Breakthrough Advancement: D-Wave unveiled its Advantage2 quantum computing system, a milestone claimed as the first real-world application of “quantum computational supremacy.” This advancement reportedly outperforms traditional classical supercomputers in specific complex problem-solving tasks.

– Market Reaction and Financials: Following the announcement, D-Wave’s quarterly bookings jumped an extraordinary 502% in Q4 to $18.3 million, with revenue forecasts surpassing analyst expectations. These factors collectively fueled investor enthusiasm and a robust rally in its stock price.

– AI Synergies: At a recent conference, D-Wave also highlighted emerging synergies between quantum computing and artificial intelligence, underlining potential applications that could revolutionize problem-solving across industries.

The sustained interest and investment in quantum computing stocks underscore a broader market optimism about this nascent technology’s commercial viability and transformative potential.

—

Moderna’s Momentum Amidst Regulatory Developments

Pharmaceutical heavyweight Moderna also featured prominently among midday movers, buoyed by recent FDA approvals and ongoing investor confidence. Moderna’s stock gains reflect:

– Product Pipeline Strength: Continued advancements and positive regulatory decisions support Moderna’s vaccine and therapeutic portfolio.

– Investor Sentiment: The biotech sector’s sensitivity to breakthroughs and regulatory news means companies like Moderna often experience volatile but upward price movements following favorable announcements.

This dynamic illustrates how biotech firms’ fortunes are heavily tied to regulatory milestones, and investors closely track these developments for trading opportunities.

—

Agilysys and Amer Sports: Sector-Specific Gains

Both Agilysys, Inc. and Amer Sports, Inc. registered notable stock gains, reflecting sector-specific factors:

– Agilysys, specializing in hospitality software solutions, benefits from ongoing digital transformation trends in hospitality and leisure industries.

– Amer Sports experienced strong first-quarter results exceeding expectations, propelling the stock higher amid confidence in its operational execution.

These cases highlight how solid earnings reports and sector-tailored growth drivers can contribute to midday stock surges independent of broader market trends.

—

Tesla’s Steady Climb Amid Leadership Commitment

Tesla (TSLA) continues to capture market attention, with shares rising over 1% propelled largely by CEO Elon Musk’s commitment to lead the company for the next five years. Key points include:

– Leadership Assurance: Musk’s renewed pledge mitigates investor concerns regarding executive transitions.

– Ongoing Innovation and Growth: Tesla’s innovation pace in electric vehicles, energy products, and expansion plans maintain its status as a high-profile, high-volatility stock.

Tesla’s share movement exemplifies how leadership stability and visionary growth prospects keep investor sentiment buoyant amid evolving market conditions.

—

Broader Market Context and Other Movers

While individual companies command headlines, the broader market backdrop adds nuance:

– Despite a recent S&P 500 rally extending six sessions, there has been some caution from investors reacting to a U.S. credit rating downgrade, injecting volatility.

– Quantum computing sector peers such as Rigetti Computing, IonQ, and Arqit Quantum have seen varied movements, with most quantum stocks appreciating amid technological optimism and strategic partnerships (e.g., Microsoft’s involvement).

– Stocks like Home Depot and Nvidia have faced selloffs despite strong earnings, signaling sector rotation or profit-taking behaviors.

This environment suggests that momentum-driven sectors coexist with risk-averse strategies, resulting in a stock market characterized by selective buying and selling based on industry trends and company-specific news.

—

Conclusion: Charting the Course Forward in Dynamic Markets

The midday stock market movements offer a vibrant tableau of cutting-edge technology breakthroughs, regulatory impacts, leadership decisions, and sector-specific earnings. D-Wave Quantum’s quantum computing surge is an especially potent signal of the future direction in technology-driven investment themes, combining innovation with tangible revenue growth. Meanwhile, Moderna, Agilysys, and Tesla demonstrate how leadership, regulatory progress, and operational execution keep traditional growth narratives alive.

Investors navigating this landscape should appreciate the layered drivers—technological advancements, regulatory developments, and earnings beats—that are catalyzing these price movements. Understanding these forces helps make sense of the dramatic shifts and positions market participants to better anticipate where the next big moves may arise. The interplay between cutting-edge innovation and fundamental business performance continues to rewrite market dynamics in fascinating and impactful ways.