Navigating the Current Stock Market Landscape: A Comprehensive Analysis

The contemporary stock market scene carries a mix of optimism and caution, shaped by multiple key factors that investors and analysts are closely tracking. Over recent weeks, equities, bonds, and the dollar have all witnessed pullbacks as concerns intensified around the U.S. budget deficit and rising national debt. This backdrop serves as a foundation for evaluating the forces currently influencing market behavior and the outlook for the near future.

—

Recent Performance: Retreat Amid Fiscal Concerns

Last week’s market retreat across different asset classes reflects investor sensitivity to fiscal developments. The growing U.S. budget deficit and mounting debt levels have revived worries about long-term economic stability. These concerns ripple through the investment ecosystem, affecting sentiments from equities to fixed income and the dollar itself. When budget deficits widen, it can trigger expectations of higher interest rates or inflation, dampening appetite for riskier assets in the short term.

—

Earnings Season: The Catalyst On the Horizon

Amid the prevailing uncertainty, the first-quarter earnings season is gaining momentum. Earnings reports remain a pivotal determinant for market direction as they provide a real-time barometer of corporate health and economic resilience. Strong earnings from leading companies, particularly in technology and consumer sectors, could bolster confidence and fuel stock gains. Conversely, any signs of earnings underperformance might exacerbate market volatility.

—

Focus on Leading Tech Giants and Market Movers

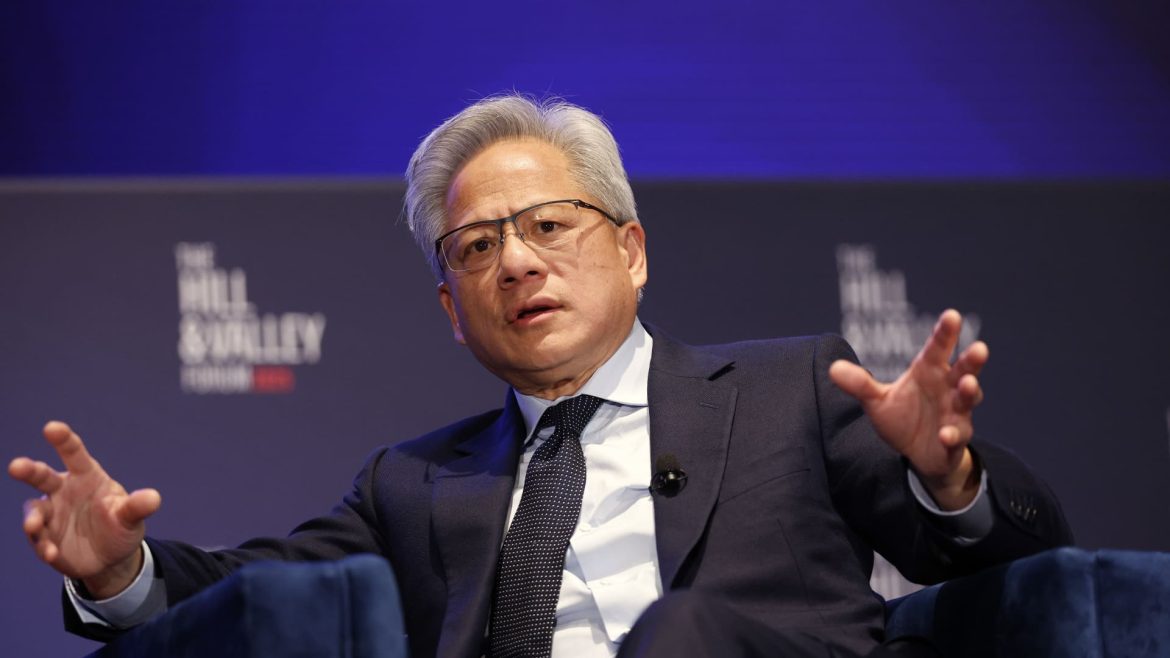

Tech corporations continue to command investor attention, with giants like Nvidia entering the spotlight in the coming week. These companies often act as bellwethers for broader market trends given their sector dominance and market capitalization. Recent rallies in tech and growth stocks have contributed significantly to upward momentum, underscoring their role as engines of market performance.

Moreover, domestic markets recently posted sharp gains driven by robust buying interest in IT and auto sectors. These positive moves suggest that selective sector strength may provide pockets of opportunity against a background of macroeconomic concerns.

—

Structural Trends and Investment Strategies in 2025

From a strategic viewpoint, investors are weighing the influence of strong U.S. corporate fundamentals coupled with major structural shifts, notably the ascendancy of artificial intelligence and technological innovation. Firms that adapt well to these mega trends are outperforming, influencing portfolio allocations.

Additionally, trade policy developments, such as anticipated impacts from tariff negotiations and U.S.-China relations, remain critical variables. Market participants are watching global economic indicators closely for any early signs of shifts in business sentiment that might stem from easing trade tensions.

Investment strategies also reflect these dynamics, with a focus on stocks exhibiting momentum and resilience in the current environment. For example, targeted buying opportunities are emerging around sectors benefiting from new trade deals or technological advancement, illustrating a nuanced approach to capitalizing on evolving market conditions.

—

Market Volatility and Outlook

The year has been characterized by bouts of volatility, marked by a rebound from a mid-March correction followed by continued oscillations. While recent gains signal resilience, uncertainty rooted in fiscal and geopolitical domains tempers enthusiasm. Investors must therefore stay attuned to a complex interplay of earnings reports, economic data releases, and policy shifts.

Despite these challenges, a cautiously optimistic stance dominates among many large investment institutions, which maintain an overweight position in U.S. equities over the medium term. Confidence hinges on corporate strength and the transformative potential of ongoing technological revolutions.

—

Conclusion: Charting a Path Through Complexity

The current stock market environment presents a layered picture: fiscal concerns and debt worries momentarily weigh on risk appetite, yet strong corporate earnings, technological leadership, and structural growth forces offer compelling reasons for optimism. Investors navigating this landscape benefit from a balanced approach that respects ongoing volatility while seeking to harness sector-specific opportunities and innovative trends.

Remaining vigilant to macroeconomic signals and earnings trajectories will be essential for making informed decisions. Ultimately, the market’s ability to reconcile near-term headwinds with long-term growth drivers will determine the trajectory of asset prices in the coming months. This nuanced understanding equips investors to move beyond noise and capitalize on what the market’s next chapters have in store.