The ‘Sell America’ Trend on Wall Street: Decoding the Causes and Implications

Introduction: The Emergence of a New Market Phenomenon

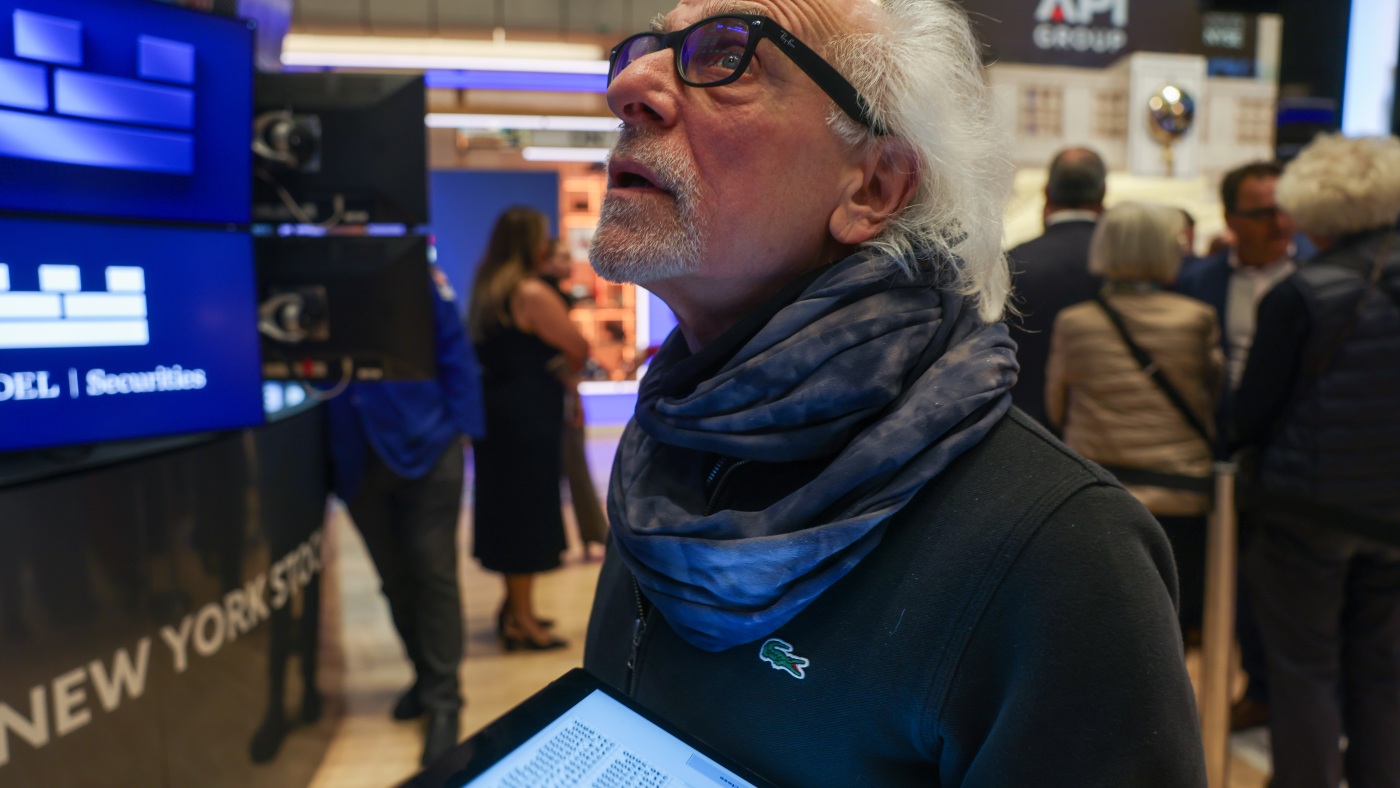

In recent weeks, headlines across financial news platforms have recurrently spotlighted a striking development on Wall Street: the rise of the “Sell America” trade. This term refers to a prominent trend where investors are actively offloading bonds and other financial instruments tied to the U.S. government, indicating a shift in confidence in America’s economic outlook. What sparked this sudden aversion, and what does it mean for investors, the U.S. economy, and global financial markets? This analysis will unpack the multifaceted drivers behind this phenomenon, scrutinize the market responses, and explore future ramifications.

Understanding the ‘Sell America’ Trade

At its core, the “Sell America” trade captures the behavior of institutional and retail investors who are hastening to exit U.S. government bonds—traditionally among the safest assets globally. Multiple recent news snippets confirm that investors are shedding these securities as part of a broader risk reassessment. The key reasons fueling this trend include:

Investors today are troubled by an evolving perception that the United States is now “a riskier place to park your cash than it was six months ago.” This growing unease springs from a confluence of factors, including political tensions, fiscal challenges, and uncertainty about monetary policy. Where U.S. Treasuries once represented a haven, shifting geopolitical and domestic developments have eroded that sanctuary status.

A critical catalyst propelling the selloff was Moody’s recent decision to downgrade the U.S. credit rating. Such a downgrade signals concerns about the ability or willingness of the U.S. government to manage its mounting national deficit and debt load effectively. This move has rattled investor confidence, as it potentially complicates negotiations around fiscal policy and federal borrowing.

President Trump’s tariff policies and confrontations with the Federal Reserve have injected further uncertainty. For instance, his pressure campaign against Federal Reserve Chairman Jerome Powell and implementation of sweeping tariffs triggered market volatility, unsettling investors who traditionally seek stability in U.S. assets. Heightened trade tensions have complicated the global economic landscape, making U.S. securities less attractive.

Market Impact: Bonds, Stocks, and the Dollar Under Pressure

Investor reactions have manifested in several interconnected market dynamics:

– Bond Market Selloff: The exodus from U.S. government bonds reflects fears that rising debt and fiscal mismanagement might lead to higher borrowing costs or inflation. As holders dump these securities, bond prices fall, and yields rise, raising concerns about the cost of servicing national debt.

– Stock Market Volatility: Wall Street has experienced turbulence, with stocks falling in response to intensified tariff wars and uncertainty about economic growth and policy direction. The “Sell America” trade signifies a broader risk-off sentiment, where equities and bonds are simultaneously pressured.

– Currency Fluctuations: The value of the U.S. dollar has also exhibited weakness as foreign investors reconsider their holdings. Weaker demand for the dollar can impact global trade and investment flows, potentially diminishing America’s financial influence internationally.

Global Implications: A Shift Away from the American Financial Powerhouse

The “Sell America” trend is not isolated—it points to a larger narrative about the United States’ evolving position in the world economy. Analysts warn that sustained capital flight may:

– Spur Investors and Countries to Diversify Holdings

Countries and global investors are increasingly eyeing alternative markets and currencies to mitigate overexposure to U.S. assets, disrupting longstanding financial ties.

– Undermine the U.S. Dollar’s Reserve Currency Status

Given the dollar’s central role in global finance, diminished confidence could erode its dominance, causing ripple effects in international trade, governance, and geopolitical power.

– Challenge American Fiscal and Monetary Policy

As borrowing costs rise due to lost confidence, the U.S. government may face difficult trade-offs, potentially impacting social programs, defense spending, and economic stimulus measures.

Potential Pathways Forward: Stabilizing the Market

Experts indicate several steps to potentially alleviate the “Sell America” pressures:

– Fiscal Responsibility and Debt Management

Addressing the national deficit through sustainable budgeting and transparent fiscal policy can rebuild market trust.

– Clarity and Predictability in Monetary Policy

Avoiding policies that stoke uncertainty—such as political interference in the Federal Reserve—can calm jittery investors.

– Managing Trade and Geopolitical Risks

De-escalating tariff battles and fostering international cooperation may restore confidence in U.S.-led economic stability.

Conclusion: A Defining Moment for U.S. Financial Markets

The resurgence of the “Sell America” trade is a stark signal that investor confidence in the United States has been shaken by a complex mix of economic, political, and fiscal challenges. While it reflects short-term trading reactions, its continuation could herald a structural shift in the global financial order. Wall Street and Washington face intertwined imperatives: to restore trust through prudent fiscal management and steady policy direction. The challenge ahead is not merely market stability but ensuring America retains its foundational position as a global economic and financial leader.