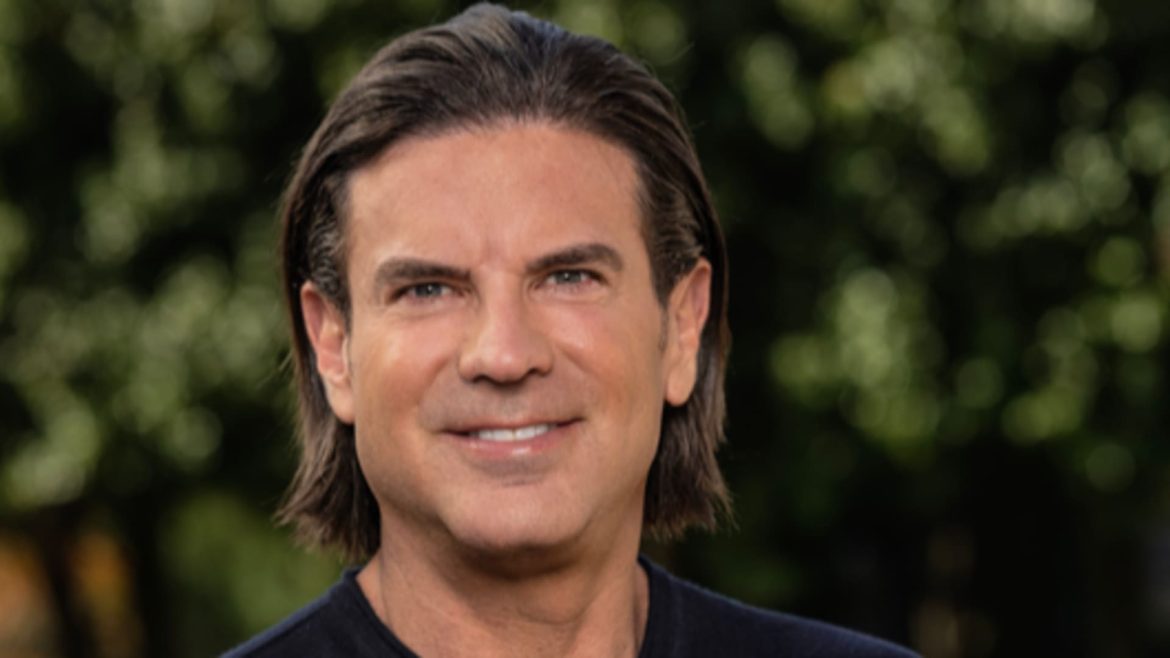

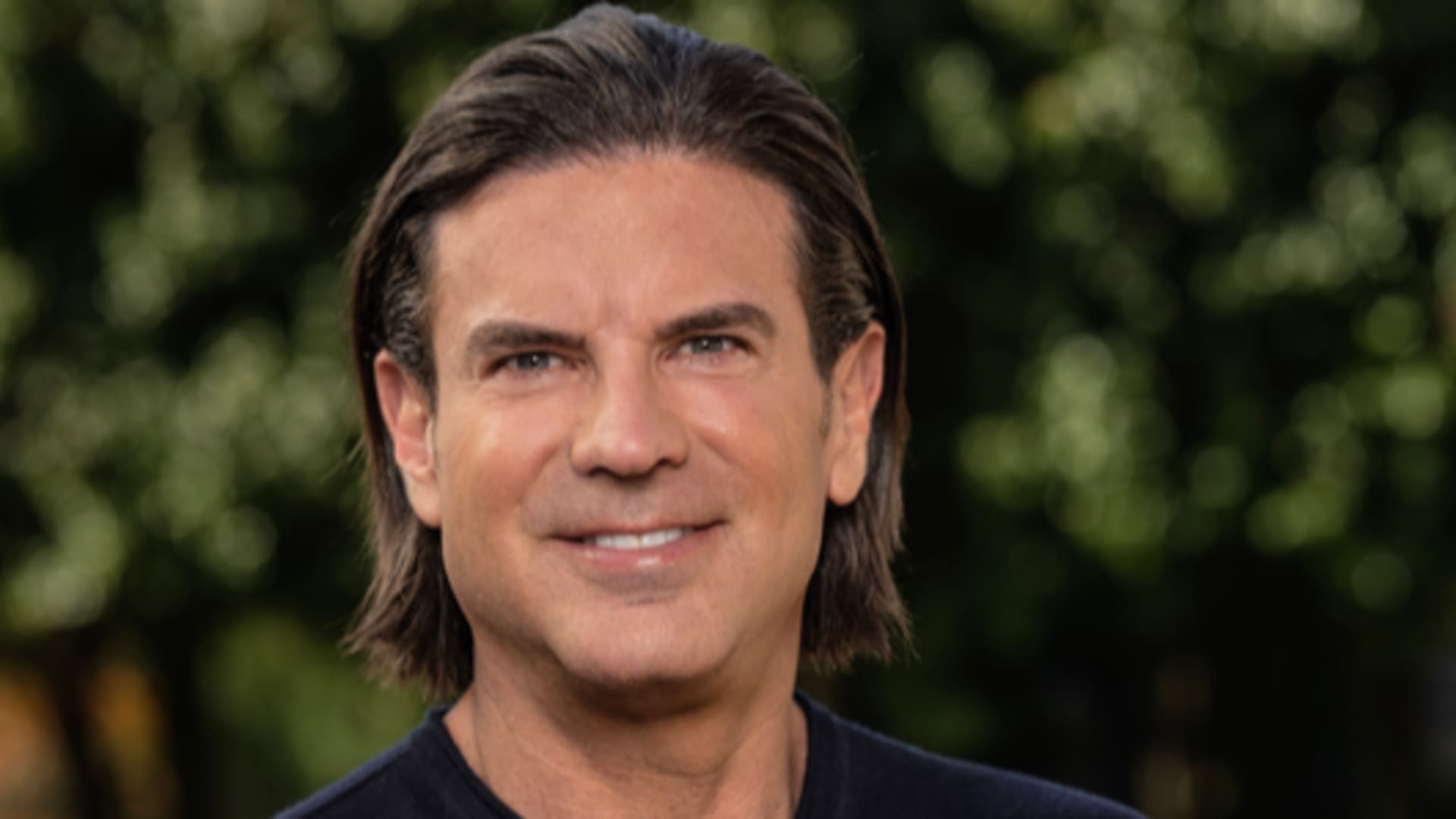

David Adelman: Architect of a New Era in Family Office Investing

David Adelman stands out as a dynamic entrepreneur and visionary investor reshaping the landscape of family offices, raising the bar on their traditional roles and impact. His trajectory from a college entrepreneur to the leader of a multi-billion-dollar investment suite reflects both a pioneering spirit and a strategic acumen rooted in broad market insight and patient capital deployment.

—

Early Entrepreneurial Foundations

Adelman’s journey began with Campus Apartments, a student housing enterprise initiated with a modest $2,000 investment during his college years. Under his stewardship, Campus Apartments evolved into one of the most significant providers of on- and off-campus student housing in the United States, boasting assets valued around $2 billion. This early success established not just financial capital but a rich knowledge base that continues to inform his investment philosophy.

—

Family Office Evolution: Darco Capital’s Innovative Approach

Founded in 2017, Darco Capital is Adelman’s Philadelphia-based family office and investment vehicle, which embodies a next-generation family office model that goes beyond mere wealth preservation. With more than 90 venture and growth capital investments, Darco Capital operates with a venture capital mindset, aggressively pursuing diverse opportunities across multiple sectors including climate technology, fintech, food & beverage, consumer brands, hospitality, and media.

Unlike conventional family offices that often prefer low-risk, passive investments, Adelman’s model emphasizes:

– Expertise-Driven Investing: Leveraging deep industry insights and entrepreneurial experience, Darco Capital provides not just capital but operational guidance, helping accelerate growth in portfolio companies.

– Patient and Flexible Capital: Family office capital, freed from the typical fund lifecycle pressures of private equity or venture funds, allows for patient investment horizons and custom-tailored strategies that foster sustainable company development.

– Active Portfolio Management: With board seats and active involvement in companies like Good Man Brand and FS KKR Capital BDC, Adelman maintains direct oversight and influence to steer growth and value creation.

—

Diversification and Expansion: From Real Estate to Spirits and Beyond

Adelman’s business interests have transcended real estate into consumer goods and alternative asset management. Notably, Darco Capital’s acquisition and development of American Harvest Vodka and Beach Whiskey under the newly formed 1776 Spirits Company illustrates a strategic move in the spirits sector. Adelman’s vision here transcends market competition; it aims to “craft a new standard,” emphasizing excellence and innovation.

Simultaneously, his co-founding of FS Investments, a leading alternative asset manager with approximately $75 billion under management, underscores a blend of entrepreneurial passion with robust financial management. This venture has positioned Adelman not only as a direct investor but also as a key figure within institutional investment communities.

—

Strategic Insights: Why Family Offices Are Distinctive Investors

David Adelman has articulated how family offices like his can afford advantages over private equity and traditional venture capital models:

– More Expertise: Family offices can deploy seasoned entrepreneurial leadership and hands-on operational guidance.

– Greater Patience: Without the constraints of fund deadlines and exit pressures, family offices can invest for the long-term health and strategic growth of businesses.

– Flexible Deal Structures: They can tailor investment terms creatively, addressing specific needs of portfolio companies and broader market conditions.

This approach has attracted attention as a progressive model, distinguishing Adelman’s Darco Capital amid the growing competition for high-quality investments.

—

Broad Impact and Recognition

Adelman’s influence stretches beyond investments. He is a limited partner in Harris Blitzer Sports & Entertainment, co-owner of prominent sports franchises such as the Philadelphia 76ers and New Jersey Devils, illustrating his multidimensional reach in business and culture.

His inclusion in lists like the Hurun UK Under40s and mentions among leading entrepreneurs emphasizes his global stature and entrepreneurial leadership before 40, reinforcing the lasting momentum he has generated.

—

Conclusion: Forging a Legacy Through Visionary Investment

David Adelman exemplifies the transformative potential of modern family offices, dynamically merging entrepreneurial vigor, strategic patience, and cross-industry diversification. His success with Darco Capital not only reshapes how family offices engage with the market but also sets a roadmap for future wealth owners aspiring to go beyond capital allocation to become true value creators.

By intertwining expert guidance with flexible, patient capital, Adelman’s model champions a new paradigm in private investing—one that is deal-hungry but principled, growth-oriented yet stable, and above all, visionary in its commitment to building enduring enterprises. This positions him at the forefront of a shifting investment landscape, where family offices evolve from passive wealth stewards to proactive investors shaping industries and communities.