The True Cost of Making a Car: Beyond the Sticker Price

Car buyers commonly confront prices around $50,000 for a new vehicle, yet this figure conceals the intricate economics behind automobile manufacturing. The cost to the manufacturer, the origin of parts, and the impact of trade policies significantly influence that retail price — often in ways consumer eyes scarcely see.

Understanding Manufacturer Costs Versus Retail Prices

Typical retail prices, such as a $50,000 sticker on a sedan, do not directly reflect the manufacturer’s cost. Industry insights reveal that such a car might cost roughly $23,000 to $25,000 to produce, meaning the remaining amount largely covers distribution, marketing, dealer profits, tariffs, taxes, and other markups.

For example, a $75,000 vehicle may incur manufacturing costs between $60,000 and $65,000, indicating a manufacturer profit margin of $10,000 to $15,000 is built into retail price. The difference accounts for complexity in supply chains, technology integration, safety, fuel efficiency features, and luxury add-ons.

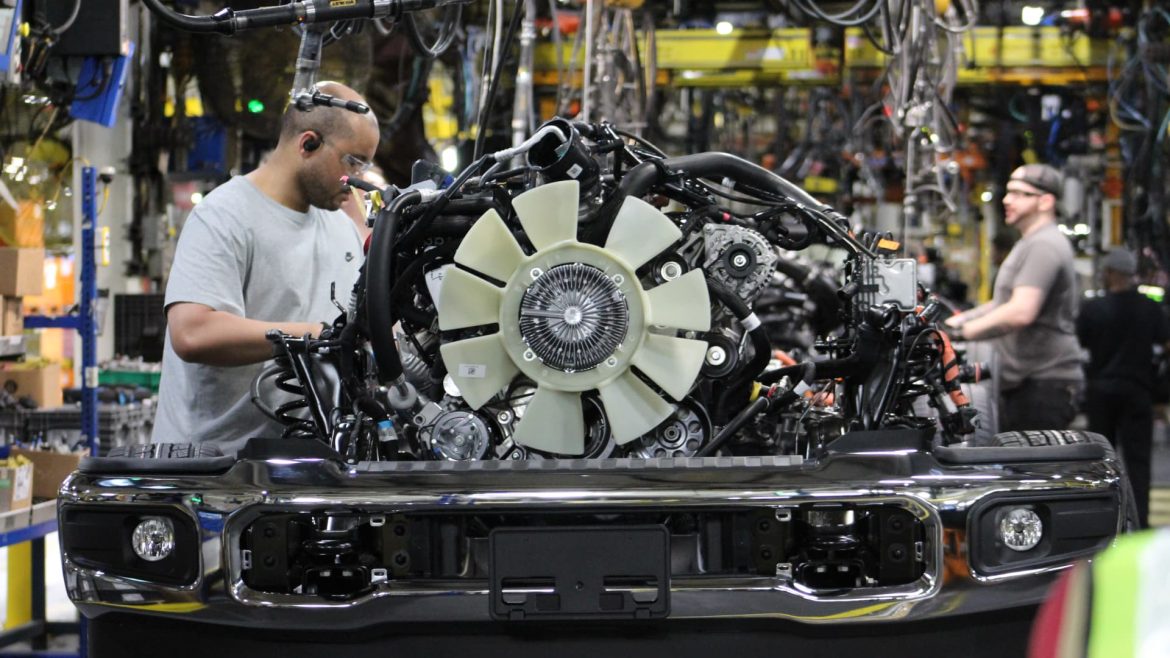

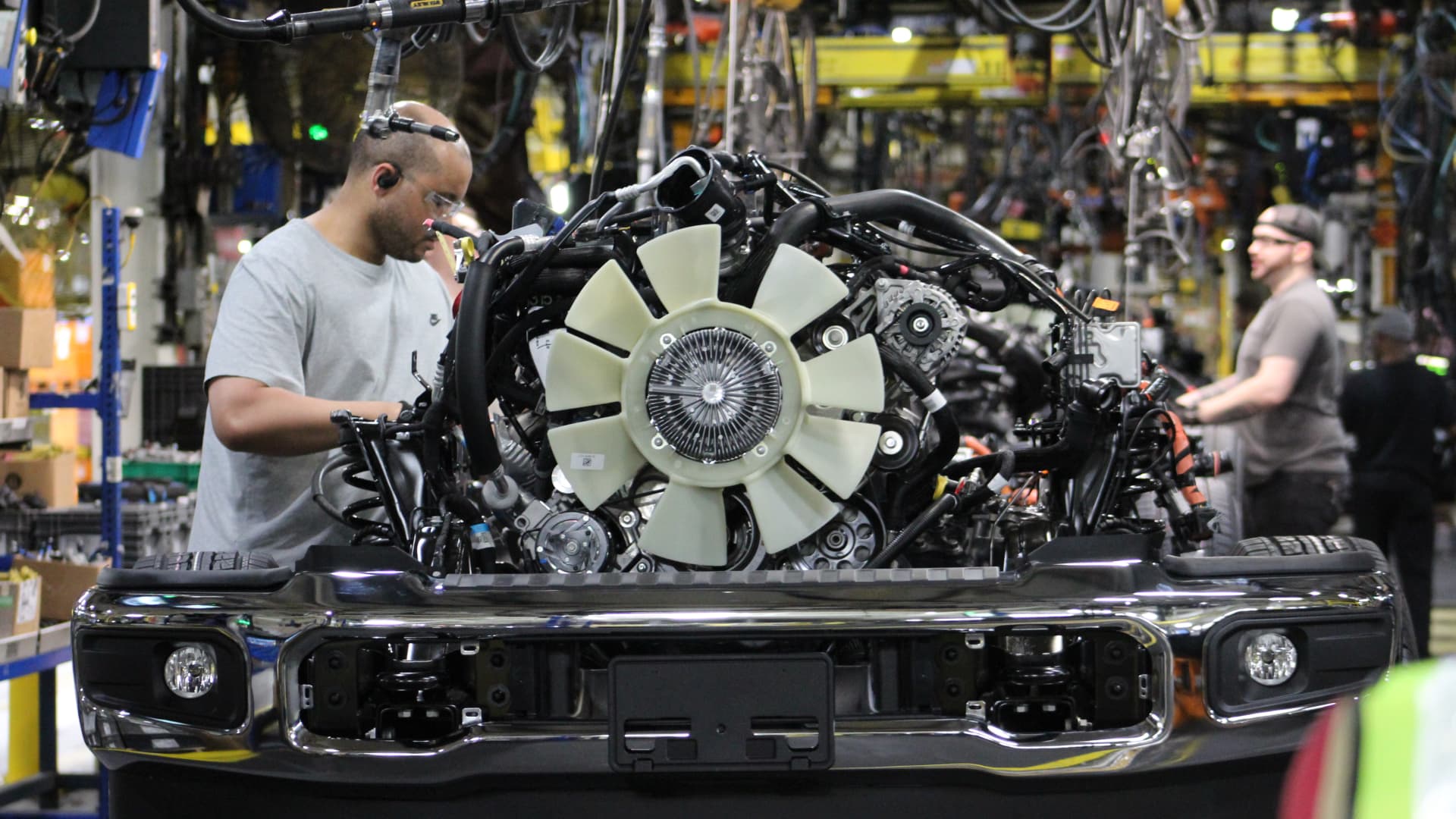

The Myth of a “100% Made in USA” Car

Despite political efforts to promote domestically built cars, the reality is far more complex. No commercially available car today is 100% made in the United States. Components and raw materials come from a global network involving Canada, Mexico, China, and beyond. For instance:

– Some vehicles like the Kia EV6 score around 80% American-made content.

– Others, such as certain Chinese imports, may boast only 5% US parts.

– Even Tesla, despite being an iconic American brand, sources many parts internationally.

This global interdependence in parts and materials is why claims or hopes for fully domestic production are practically infeasible at once.

Tariffs: A Double-Edged Sword

The Trump administration’s imposition of 25% tariffs on cars and automotive parts not made in the U.S. aimed to revive domestic production. However, economists warn of unintended consequences:

– Tariffs can add between $3,000 and $10,000 to vehicle prices depending on origin and domestic content.

– Analysts estimate these tariffs could cost American consumers an extra $100 billion annually.

– Increased prices may dampen consumer demand, potentially hurting overall production volumes and employment, counter to tariff goals.

– Supply chain entanglements mean automakers face difficult choices on sourcing, production location, and pricing strategies.

Price Increases: More Than Just Tariffs

Auto prices rising toward and beyond $50,000 cannot solely be blamed on tariffs. Other factors play significant roles, including:

– Supply chain disruptions, particularly from the COVID-19 pandemic aftermath.

– Rising raw material costs like steel, aluminum, and semiconductor chips.

– Increased demand for advanced technologies, electrification, and safety features.

– Labor costs and regulations influencing production expenses.

All these converge to push the average new car price upward, straining affordability for a typical buyer.

What Does “American-Made” Really Mean?

The American-Made Index by Cars.com and studies from automotive analysts reveal graded scales of domestic content, rather than a simple binary of American or foreign:

– Vehicles with 70-80% US content are considered highly American-made.

– The Ford F-150, a longstanding best-seller, is noted for the highest proportion of US-based parts and assembly among Detroit automakers.

– The complexities of global supply chains mean parts from electronics, tires, and steel might still be imported yet assembled domestically.

This nuanced picture suggests consumer preferences for “American” cars require understanding these gradations rather than simplistic labels.

Navigating Future Auto Market Realities

As manufacturing costs rise and the global nature of supply chains persists, American automakers and consumers face significant challenges ahead.

– Policies aiming to protect domestic jobs via tariffs could inflate prices, potentially pricing out some buyers.

– Automakers must balance sourcing locally to avoid tariffs with access to competitive parts globally to maintain profitability.

– Consumers prioritizing domestic production may pay premiums or find limited options.

– Innovation in production efficiency, material sourcing, and supply chain resilience will be critical to controlling costs.

Conclusion: The Price of American Automotive Independence

Achieving a car that’s completely made in the U.S. remains an elusive goal given globalized manufacturing networks. While tariffs and political ambitions strive to bolster domestic production, they risk making cars more expensive and less accessible. The cost to the manufacturer embedded in each sticker price reflects a complicated interplay of parts origin, labor, materials, and policy decisions.

Understanding these deeper layers helps consumers appreciate the true factors shaping the cost of the cars they drive. Navigating this landscape requires balancing patriotism, economics, and practical realities—recognizing that every dollar paid at the dealership is the sum of countless interwoven elements stretching far beyond national borders.