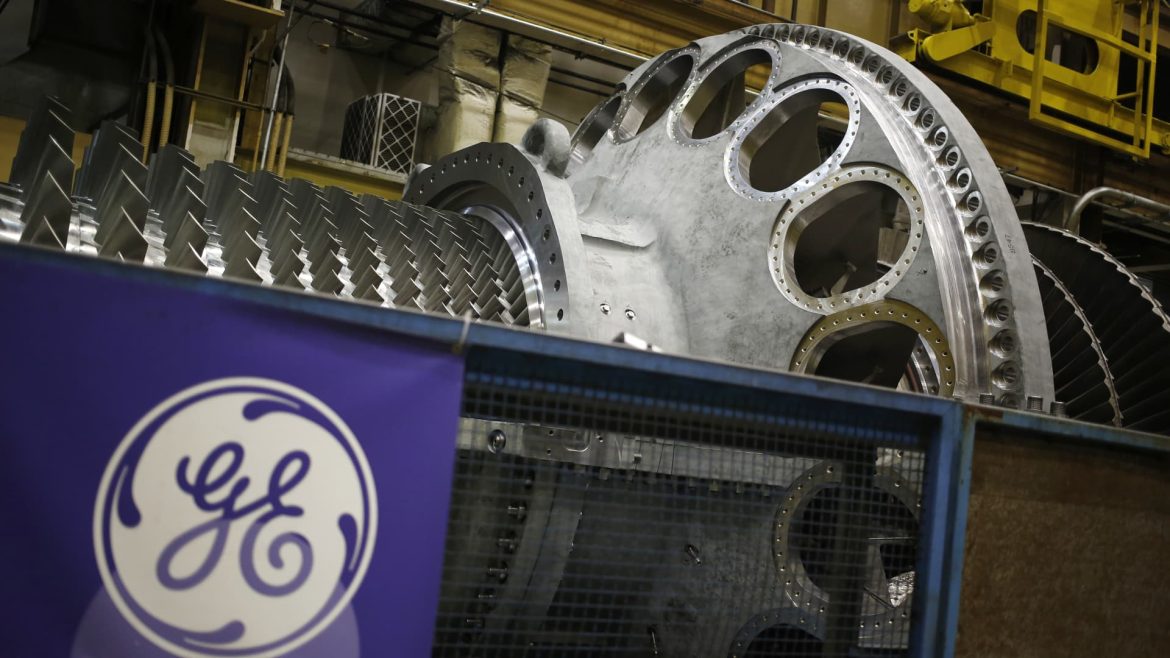

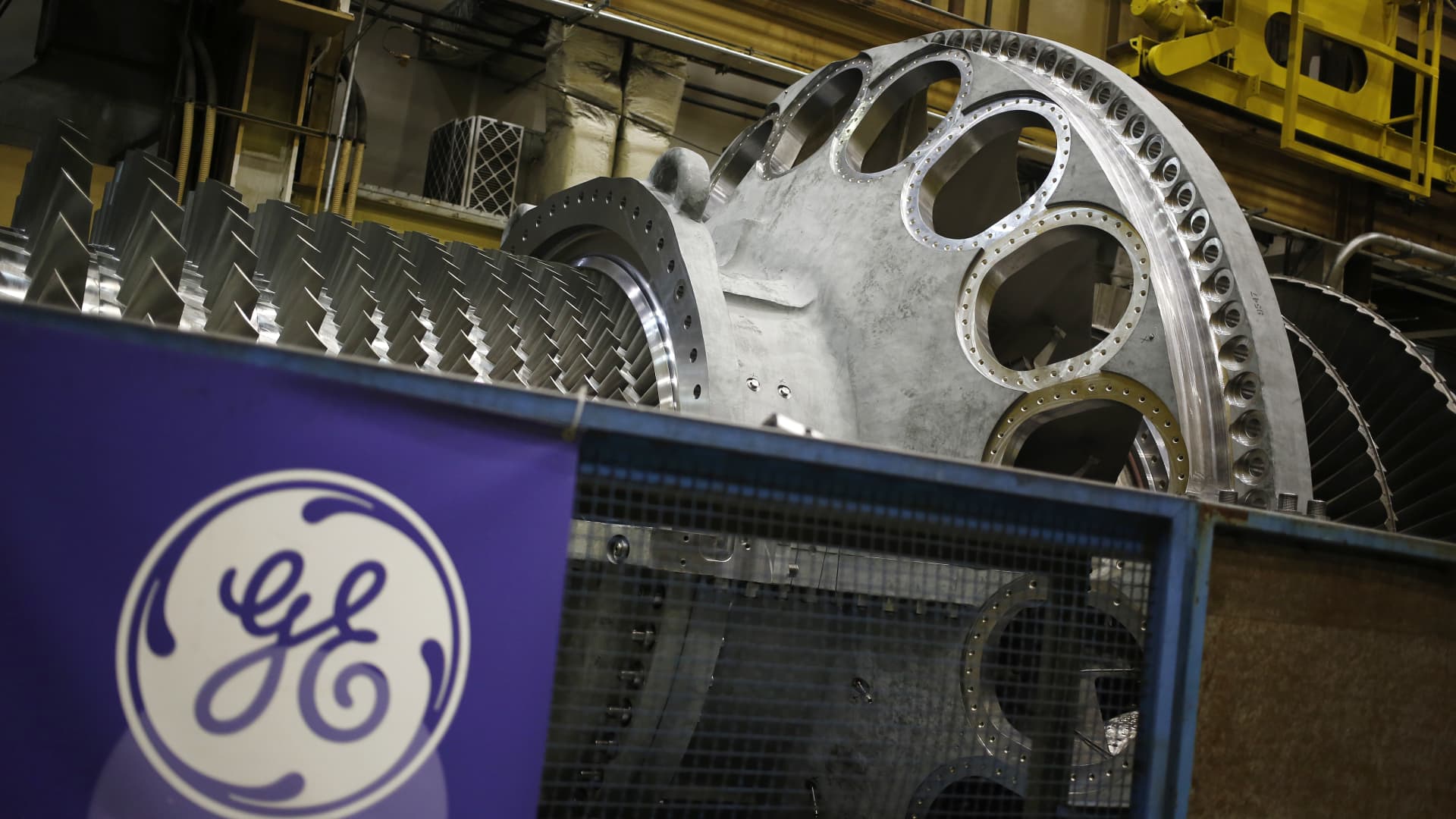

Navigating Challenges and Charting Growth: A Deep Dive into GE Vernova’s Strategic Path

Introduction: The Crossroads of Opportunity and Challenge

The energy sector is undergoing a profound transformation, driven by the urgent need for sustainable solutions and the global push towards decarbonization. Amidst this backdrop, GE Vernova finds itself at a critical juncture. Recent credit rating downgrades from Moody’s and S&P have cast a shadow over the company’s financial health, sparking debates about its ability to navigate the complexities of the renewable energy landscape. However, beneath the surface, GE Vernova’s story is one of resilience, strategic adaptation, and a clear vision for growth. This report delves into the nuances of the company’s current situation, exploring the implications of the downgrades, the company’s strategic response, and the broader industry dynamics that shape its trajectory.

Understanding the Downgrades: A Closer Look at the Credit Rating Actions

Credit rating downgrades are not merely financial footnotes; they are signals that can reverberate through a company’s operations, influencing borrowing costs, investor confidence, and access to capital. For GE Vernova, the downgrades from Moody’s and S&P reflect a confluence of factors, primarily centered around the company’s debt levels following its spin-off from General Electric. The energy sector, particularly the renewable energy segment, is capital-intensive and cyclical, requiring substantial investments in infrastructure and technology. Credit rating agencies, in their assessments, likely weighed these factors against GE Vernova’s ability to manage its debt obligations effectively.

It is essential to contextualize these downgrades within the broader landscape of credit rating methodologies. Ratings are not static; they evolve as new information becomes available and as companies execute their strategic plans. The downgrades, therefore, should not be interpreted as definitive judgments but rather as snapshots of the company’s financial health at a particular point in time. Moreover, the energy sector is currently grappling with supply chain disruptions, inflationary pressures, and regulatory uncertainties, all of which can impact a company’s financial performance and creditworthiness.

The Company’s Strategic Response: Building Resilience and Seizing Opportunities

In the face of adversity, GE Vernova has demonstrated a proactive approach, emphasizing its strong liquidity position and outlining a clear path forward. The company’s $4 billion cash buffer provides a crucial financial cushion, enabling it to manage its debt obligations and invest in growth opportunities. This liquidity is not merely a safety net; it is a strategic asset that allows GE Vernova to navigate the volatility of the energy sector and capitalize on emerging opportunities.

GE Vernova’s bullish outlook is underpinned by projected annual revenue growth of 10% in its wind and grid solutions segments. This optimism is rooted in the increasing global demand for renewable energy technologies, driven by climate change concerns, regulatory mandates, and technological advancements. If these projections materialize, GE Vernova could significantly enhance its financial profile, potentially regaining its previous credit ratings and solidifying its position as a leader in the renewable energy sector.

Industry-Wide Challenges: Navigating a Complex Landscape

The energy sector is not operating in a vacuum; it is influenced by a myriad of factors that shape the operating environment for companies like GE Vernova. Supply chain disruptions, exacerbated by the global pandemic and geopolitical tensions, have led to delays and increased costs for renewable energy projects. Inflationary pressures have further compounded these challenges, squeezing profit margins and straining financial resources.

Regulatory uncertainties add another layer of complexity. Governments around the world are implementing policies to promote renewable energy adoption, but the pace and nature of these policies vary significantly across regions. This regulatory patchwork can create operational challenges for companies operating on a global scale, requiring them to adapt their strategies to comply with diverse regulatory frameworks.

Despite these challenges, the renewable energy sector presents immense growth opportunities. The global push towards decarbonization is driving demand for clean energy solutions, creating a favorable market environment for companies that can deliver innovative and cost-effective technologies. GE Vernova, with its expertise in wind and grid solutions, is well-positioned to capitalize on this trend, provided it can navigate the industry’s complexities effectively.

Market Sentiment and Investor Confidence: The Stock Market’s Forward-Looking Perspective

The stock market’s reaction to GE Vernova’s downgrades provides valuable insights into investor sentiment and the company’s future prospects. Despite the downgrades, GE Vernova’s stock has gained 18% this year, a testament to investors’ confidence in the company’s long-term growth potential. This apparent disconnect between credit rating actions and stock performance can be attributed to several factors.

First, the stock market is inherently forward-looking. Investors often focus on a company’s growth prospects and strategic initiatives, rather than dwelling on its current financial challenges. In GE Vernova’s case, investors may be betting on the company’s ability to capitalize on the renewable energy boom, driven by the global transition towards sustainable energy solutions.

Second, the market is efficient, and information is often incorporated into stock prices before official announcements. This means that the downgrades may have already been priced in, and the stock’s performance reflects a more nuanced assessment of the company’s prospects.

Finally, some investors may view the downgrades as a buying opportunity. If they believe that GE Vernova can successfully execute its turnaround plan and deleverage its balance sheet, the current stock price may represent an attractive entry point, offering the potential for significant returns as the company’s financial health improves.

Strategic Focus Areas: Charting a Path to Sustainable Growth

While GE Vernova has a solid foundation and promising growth prospects, several strategic focus areas warrant careful attention to ensure long-term success.

Debt Management: The Path to Financial Stability

Deleveraging the balance sheet should be a top priority for GE Vernova. High debt levels can constrain a company’s financial flexibility, limiting its ability to invest in growth opportunities and weather economic downturns. To address this challenge, GE Vernova needs to demonstrate a clear commitment to reducing its debt burden through a combination of cost-cutting measures, asset sales, and improved cash flow generation. This approach will not only enhance the company’s financial stability but also signal to credit rating agencies and investors that it is serious about improving its creditworthiness.

Operational Efficiency: Enhancing Profitability and Cash Flow

Improving operational efficiency is essential for enhancing profitability and cash flow, which are critical for supporting the company’s growth initiatives. This includes streamlining processes, optimizing supply chains, and reducing manufacturing costs. By implementing lean manufacturing principles and leveraging digital technologies, GE Vernova can enhance its operational agility and responsiveness, enabling it to better serve its customers and capitalize on market opportunities.

Innovation and Technology: Maintaining a Competitive Edge

Investing in research and development is crucial for maintaining a competitive edge in the rapidly evolving energy sector. GE Vernova should focus on developing innovative technologies that improve the efficiency, reliability, and affordability of renewable energy solutions. This includes advancing wind turbine technology, enhancing grid modernization efforts, and exploring complementary energy solutions such as energy storage and demand response systems. By staying at the forefront of technological innovation, GE Vernova can differentiate itself in the market and capture a larger share of the growing renewable energy sector.

Market Expansion: Diversifying Revenue Streams

Expanding into new markets and diversifying its product portfolio can help GE Vernova reduce its reliance on specific regions or technologies. This includes exploring opportunities in emerging markets, where demand for renewable energy solutions is growing rapidly. Additionally, investing in complementary energy solutions, such as energy storage and grid modernization, can help GE Vernova create new revenue streams and enhance its market position. By diversifying its business portfolio, GE Vernova can mitigate risks and create a more resilient and sustainable business model.

The Role of Market Sentiment: Building Trust and Confidence

Market sentiment plays a pivotal role in shaping a company’s valuation and investor confidence. Favorable news, positive analyst reports, and strong earnings announcements can boost investor enthusiasm, driving up the stock price and attracting long-term capital. Conversely, negative news, disappointing earnings, and macroeconomic concerns can dampen investor sentiment, leading to a decline in the stock price.

GE Vernova needs to actively manage its public image and communicate effectively with investors. This includes providing clear and transparent updates on its financial performance, strategic initiatives, and market outlook. Building trust and confidence among investors is essential for sustaining a healthy valuation and attracting long-term capital. By fostering open and honest communication, GE Vernova can create a positive narrative around its growth prospects and resilience, thereby enhancing its market standing.

The Geopolitical Context: Navigating a Complex Global Landscape

The global energy landscape is increasingly shaped by geopolitical factors, including energy security, climate change, and international trade agreements. These factors can significantly impact the energy sector, influencing market dynamics, regulatory frameworks, and operational challenges.

GE Vernova needs to navigate these geopolitical complexities carefully. This includes diversifying its supply chains to mitigate risks associated with geopolitical tensions, adapting to changing regulatory environments, and collaborating with governments and international organizations to promote its sustainable energy solutions. By proactively addressing geopolitical risks and leveraging international partnerships, GE Vernova can enhance its market access and strengthen its position in the global energy transition.

Conclusion: Resilience, Adaptation, and the Pursuit of a Sustainable Future

GE Vernova’s journey is far from over. It is a story of resilience, adaptation, and the pursuit of a cleaner, more sustainable energy future. While the path ahead may be fraught with challenges, the company has the resources, expertise, and market opportunity to navigate these obstacles and emerge as a leader in the global energy transition. The recent downgrades, while concerning, do not represent a fatal blow. Instead, they serve as a catalyst for GE Vernova to refine its strategic focus, enhance its financial discipline, and accelerate its growth initiatives.

The renewable energy sector is poised for significant growth, driven by the urgent need for sustainable solutions and the global push towards decarbonization. GE Vernova, with its strong liquidity, projected revenue growth, and bullish market sentiment, is well-positioned to capitalize on this trend. By focusing on debt management, operational efficiency, innovation, and market expansion, the company can chart a path to sustainable growth and long-term success.

In the end, GE Vernova’s story is not just about weathering the storm; it’s about harnessing the wind. It’s about embracing the challenges of the energy transition and forging a future that is cleaner, more sustainable, and more resilient. The journey ahead is challenging, but with a clear vision, strategic focus, and unwavering commitment, GE Vernova can ride the Vernova wave and emerge as a beacon of innovation and leadership in the renewable energy sector.