The Strategic Reversal: Warner Bros. Discovery’s Bold Decision to Split

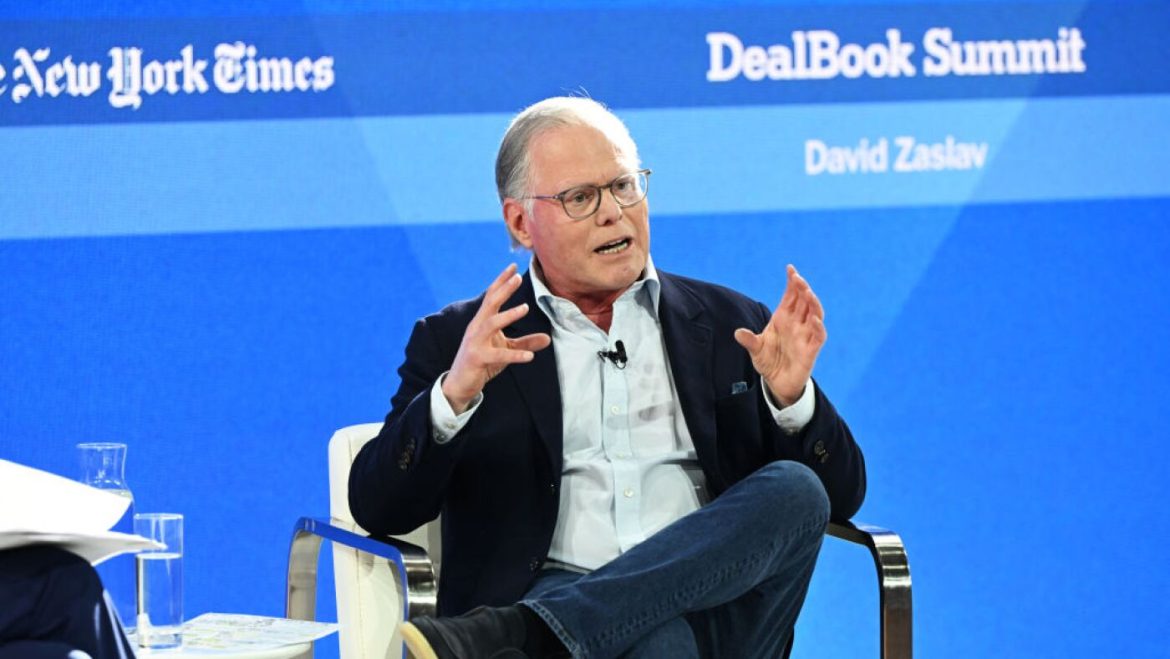

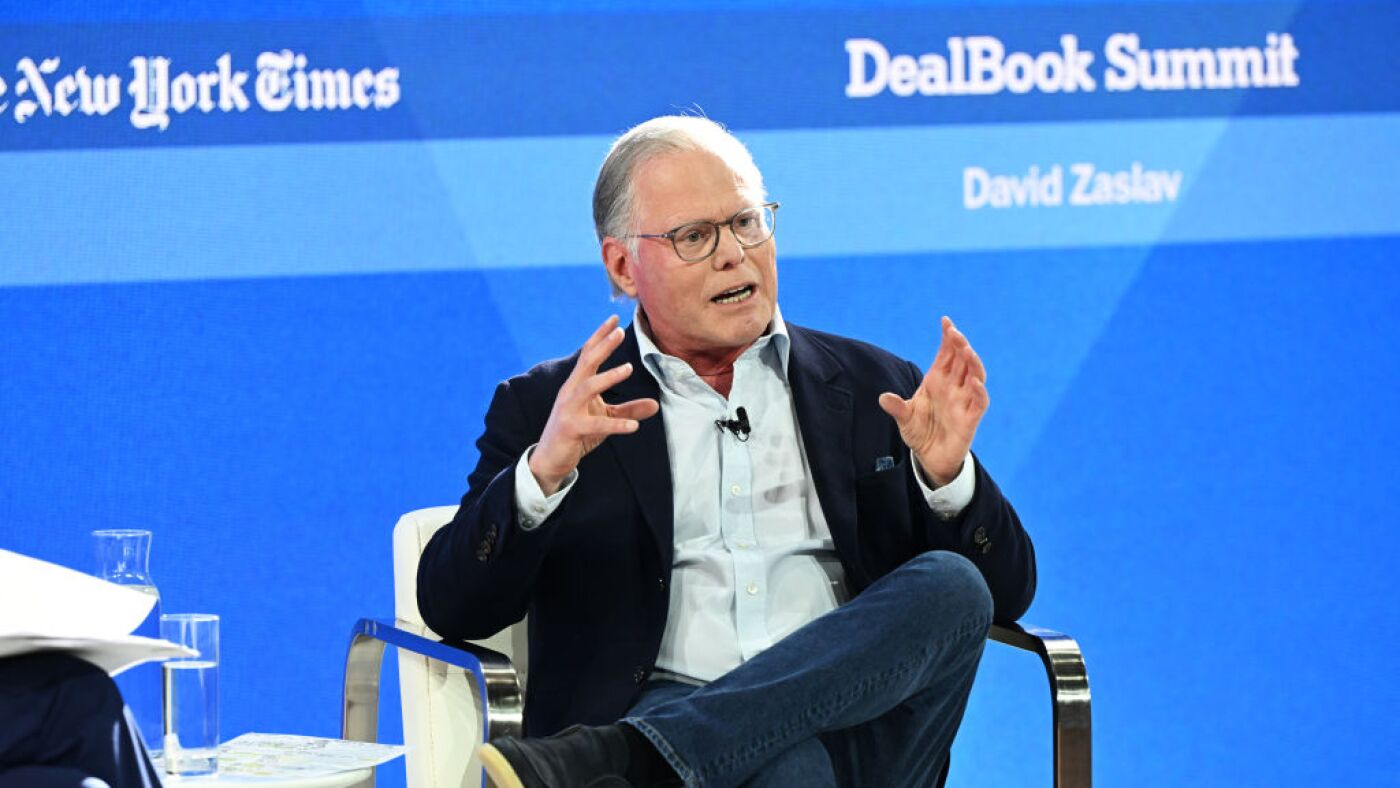

Warner Bros. Discovery (WBD), a giant in the media landscape, has announced a significant structural shift: the company will divide into two distinct publicly traded entities. This move, spearheaded by CEO David Zaslav, marks a notable retreat from the ambitious consolidation strategies once envisioned for the mega-media conglomerate. As the dust settles on years of sweeping mergers and acquisitions, this split underscores a candid adaptation to market realities, investor skepticism, and the tumultuous evolution of the media ecosystem.

Context and Explanation of the Split

The decision to bifurcate Warner Bros. Discovery emerges amid pressures from multiple fronts. The media giant’s portfolio spans a vast spectrum, including the Warner Bros. studios, HBO and HBO Max streaming platforms, Discovery’s cable networks, and other cable television channels such as CNN and TNT. However, the demands of these diverse segments diverge sharply.

On one hand, streaming and studios operate in a digital-first, content-driven growth arena, fiercely competitive and requiring heavy investment to cultivate subscriber bases and produce compelling original content. On the other, traditional cable networks face systemic decline, grappling with shrinking audiences as cable subscriptions dwindle worldwide. This divergence imposes conflicting strategies and financial models that proved increasingly difficult for a single entity to reconcile effectively.

David Zaslav, who leads the company, acknowledged that the businesses should have been separated years ago, citing the long-ago concerns voiced by industry leaders like Disney’s Robert A. Iger. Now, the formal announcement splits Warner Bros. Discovery into a “Streaming & Studios” company and a separate “Global Networks” company focusing on cable and related linear operations.

Leadership and Structural Consequences

Post-split, Zaslav will helm the streaming and studios business, reflecting his continued focus on content creation and digital transformation. Meanwhile, CFO Gunnar Wiedenfels transitions to lead the global networks business, signaling a shift aimed at preserving and shepherding legacy cable assets amid industry contraction. This delineation of leadership underscores a strategic focus: the streaming entity seeks growth and reinvention, while the networks arm prioritizes operational cash preservation and stabilization.

The split is anticipated to be completed by mid-2026, contingent on board approvals, tax structuring, and regulatory clearances. This phased timeline reflects the complexity of disentangling assets, financial arrangements, and market positioning.

Financial and Market Implications

Warner Bros. Discovery accepted the realism of Wall Street’s skepticism toward maintaining a sprawling conglomerate with competing business models. Investors responded positively to the announcement, with the company’s stock surging roughly 15% following news of the separation plans. This reaction reflects optimism that independent, focused companies may better unlock shareholder value than a conglomerate balancing divergent priorities.

The streaming division, anchored by HBO Max alongside Warner Bros. Television, Warner Bros. Pictures, and DC Studios, is positioned as a growth engine aimed at capitalizing on content-demand dynamics in the digital subscription economy. Conversely, the global networks company, including channels like CNN and HGTV, must innovate within a shrinking cable ecosystem where advertising and subscriber revenues are under pressure.

The separation allows each entity to pursue tailored strategies, capital allocation, and partnerships better suited to their distinct markets. This focused approach may improve operational agility and investor clarity, crucial in a media landscape defined by rapid technological change and consumer behavior shifts.

Revisiting Zaslav’s Ambitions and The Reality Check

The breakup marks a significant pivot from David Zaslav’s earlier grand vision of integrating Discovery’s factual and lifestyle content with Warner Bros.’ entertainment assets to form a media titan capable of dominating both traditional and streaming worlds. Announced just three years ago, the ambitious merger was expected to realize synergies and competitive scale. However, the unfolding realities of heavy debt burdens from acquisitions, intense competition with streaming rivals, and the relentless decline of cable TV forced a reappraisal.

This is not merely a structural tweak but a candid acknowledgment that a one-size-fits-all mega-conglomerate model is untenable in today’s fractured media market. Zaslav’s decision to retreat from the initial plan to instead create two streamlined, focused companies represents pragmatism over hubris, and an acceptance that specialization may yield better prospects than sprawling diversification amid ongoing disruption.

Strategic Implications for Industry and Competitors

WBD’s decision highlights broader tensions in the media industry grappling with the “streaming wars” and rapid digital transitions. Many legacy studios and networks face questions about how best to adapt: whether to double down on streaming, seek scale through mergers, or carve out niches.

The split sends a message that nimbleness and clear market focus may trump mega-mergers when balancing legacy media with digital futures. Competitors like Disney, Netflix, and Paramount will watch closely how well Warner Bros. Discovery’s two new entities perform, potentially recalibrating their strategies based on this experiment in disentangling old and new media business models.

Conclusion: A New Chapter Rooted in Focus and Realism

Warner Bros. Discovery’s impending split is a striking emblem of the seismic shifts reshaping the global media industry. By breaking apart the sprawling conglomerate into two specialized public companies—one championing growth in streaming and studios, the other stewarding a contracting cable legacy—David Zaslav has stepped back from earlier grand designs to embrace focused, realistic strategies aligned with distinct markets.

This move could not only unlock shareholder value and operational efficiency but also exemplify a larger industry trend: a willingness to adapt boldly and transparently amid uncertainty. The new Warner Bros. Discovery entities will be defined not just by their venerable histories, but by how deftly they navigate the fast-evolving demands of viewers, advertisers, and investors poised on the frontline of media transformation.